In this article

MEM Organization Structure

In some situations a flat organization structure is sufficient to meet the needs of a company for Intercompany purposes. In a standard organization structure, all legal entities are at the same level and intercompany (Due To/From) distributions are created directly between the entities when more than one legal entity is involved in a transaction. ![]() View example.

View example.

However in other situations, an organization structure is needed to affect how intercompanies are done. In this case, different levels of entities exist that are separate legal entitles and there may be situations where subentities within the same legal entity are needed. For these subentities, intercompany distributions are not performed because the transaction is between entities within the same legal entity. ![]() View example.

View example.

The organization structure setup can be used to control the following results from intercompanies:

- Disable intercompanies between entities that are not separate legal entities and intercompanies are not required

- Disable intercompanies between entities that are not separate legal entities for specific transaction types

- Flow intercompany distributions between two entities through the organization structure either through a single parent entity or through the actual parent-child structure

Review the following scenarios to better understand how the use of organization structure works.

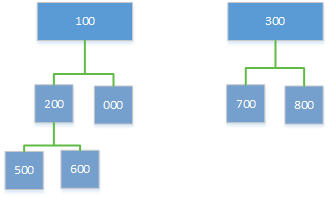

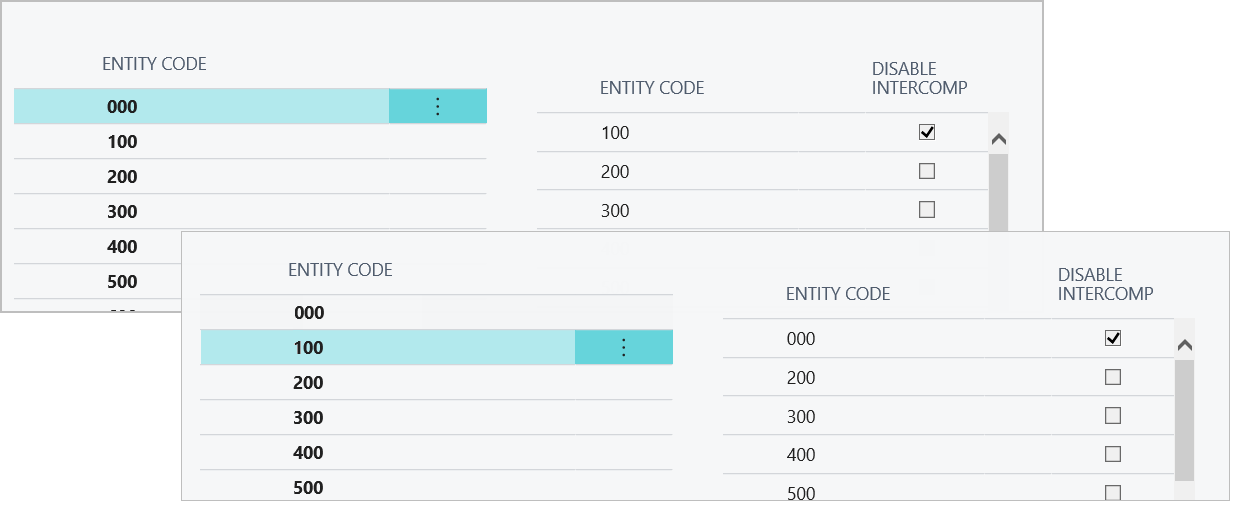

Ex1: Disable Intercompany Where Organization Structure is Set Up

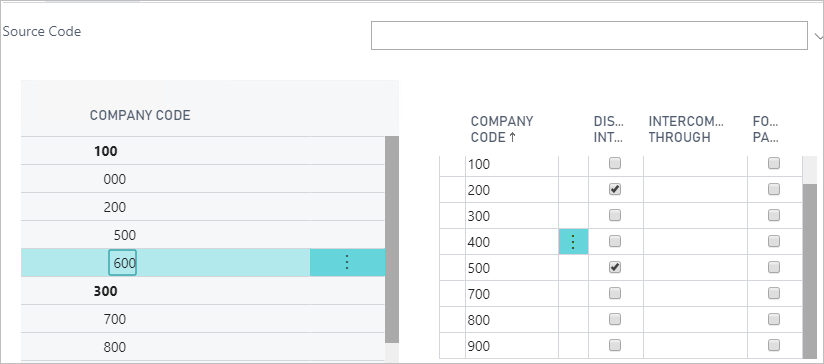

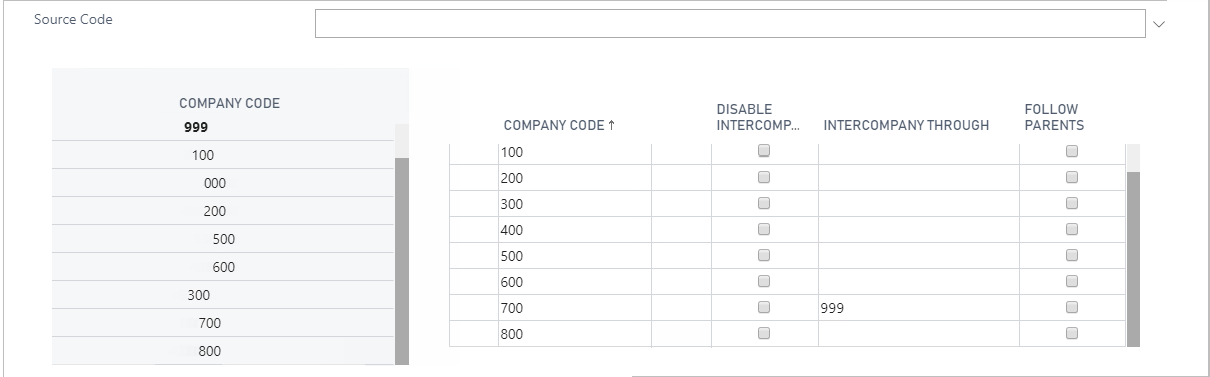

The MEM Organization Structure Setup page is setup as follows:

- Entity 100 and 300 are two separate legal entities.

- For entity 100, two subentities exist: 000 and 200.

- For entity 200, two subentities exist: 500 and 600.

- For entity 300, two subentities exist: 700 and 800.

- For entity 100, two subentities exist: 000 and 200.

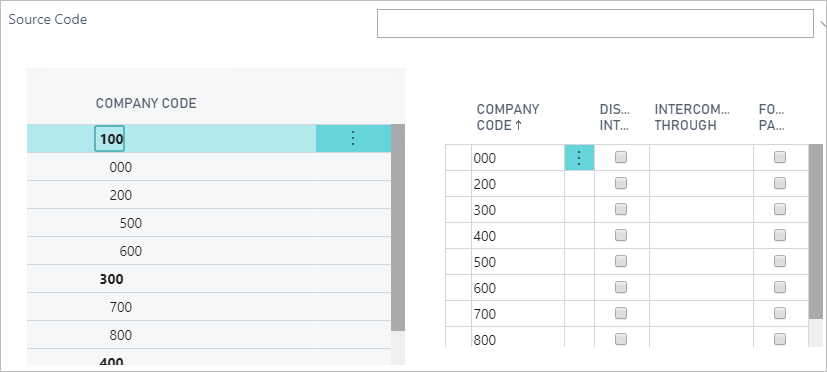

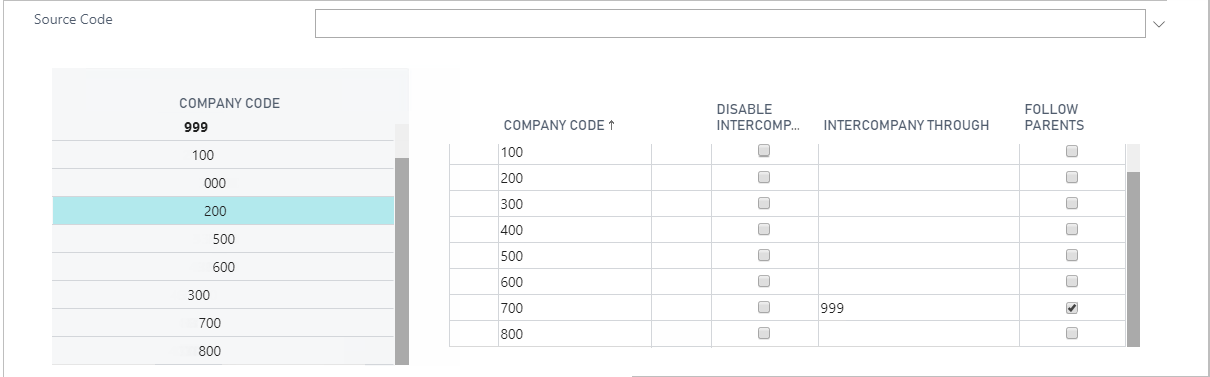

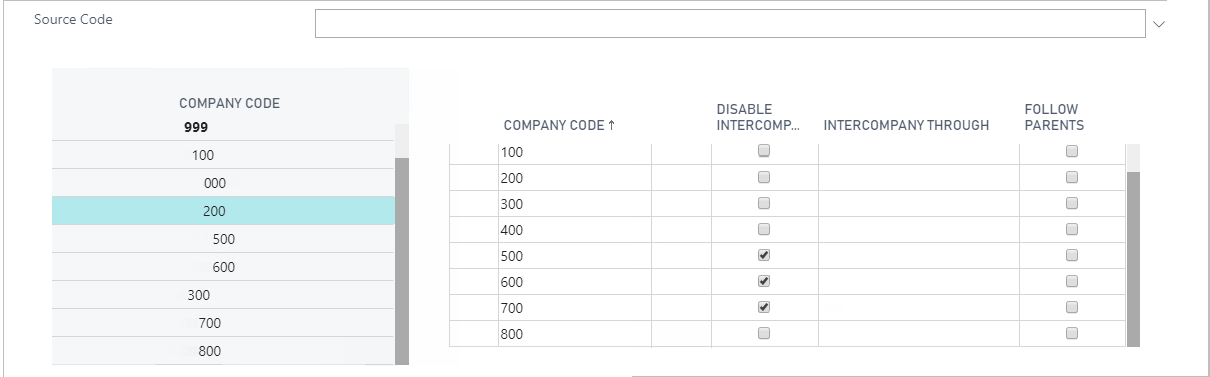

Entity 200: When entity 200 is selected from the list on the left, all entities except 200 appear in the list on the right.

- When Disable Intercompany is selected for subentities 500 and 600, intercompany transactions between the following entities do not occur:

- 200 and 500

- 200 and 600

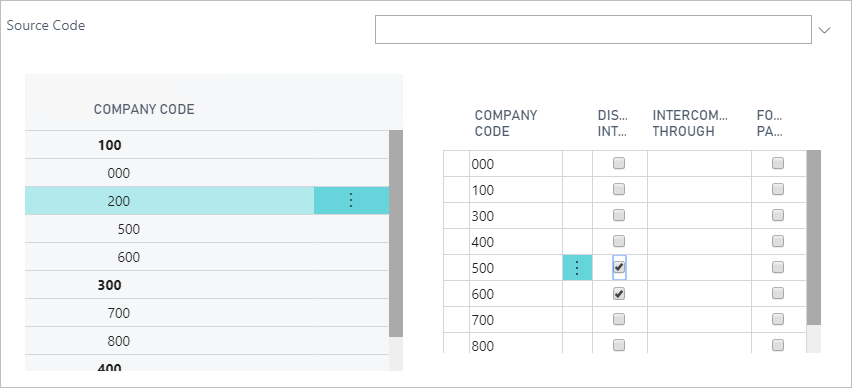

Entity 500: When entity 500 is selected from the list on the left, all entities except 500 appear in the list on the right.

- From entity 200, Disable Intercompany was selected for entity 500. As a result, the same is true for entity 500. Intercompany distributions do not occur for transactions between entities 500 and 200.

- When Disable Intercompany is selected for entity 600, intercompany distributions do not occur for transactions between entities 600 and 500.

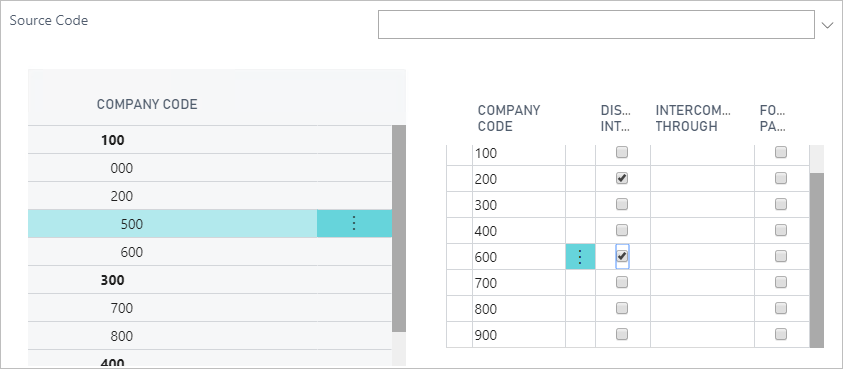

Entity 600:When entity 600 is selected from the list on the left, all entities except 600 appear in the list on the right.

- From entity 200, Disable Intercompany was selected for entity 600. As a result, the same is true for entity 600. Intercompany distributions do not occur for transactions between entities 600 and 200.

- From entity 500, Disable Intercompany was selected for entity 600. As a result, the same is true for entity 600. Intercompany distributions do not occur for transactions between entities 600 and 500.

Entity 300:When entity 300 is selected from the list on the left, all entities except 300 appear in the list on the right.

- When Disable Intercompany is selected for entity 700, intercompany distributions do not occur for transactions between entities 300 and 700.

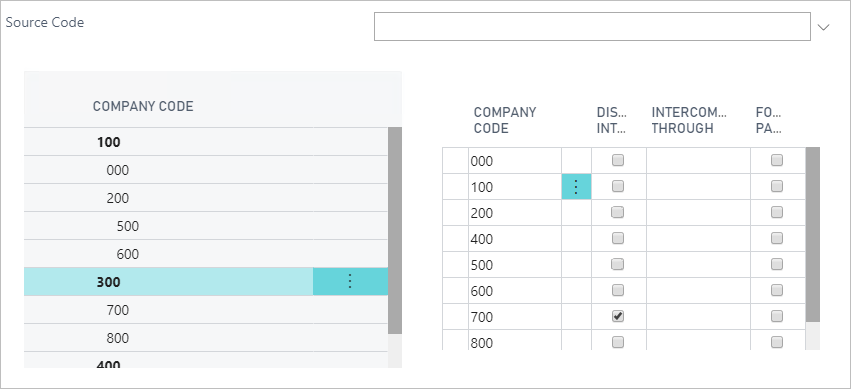

Ex2: Organization Structure Not Set Up

No organization structure between entities is set up. Both lists show all available entities. When an entity is selected in the list on the left, all entities (except for the selected entity) appear in the list on the right.

When Disable Intercompany is selected for any entity, the option is also selected for the reversed direction. For example, entity 000 is selected from the list on the left, and Disable Intercompany is selected for entity 100. When entity 100 is selected from the list on the left, Disable Intercompany is already selected for entity 000.

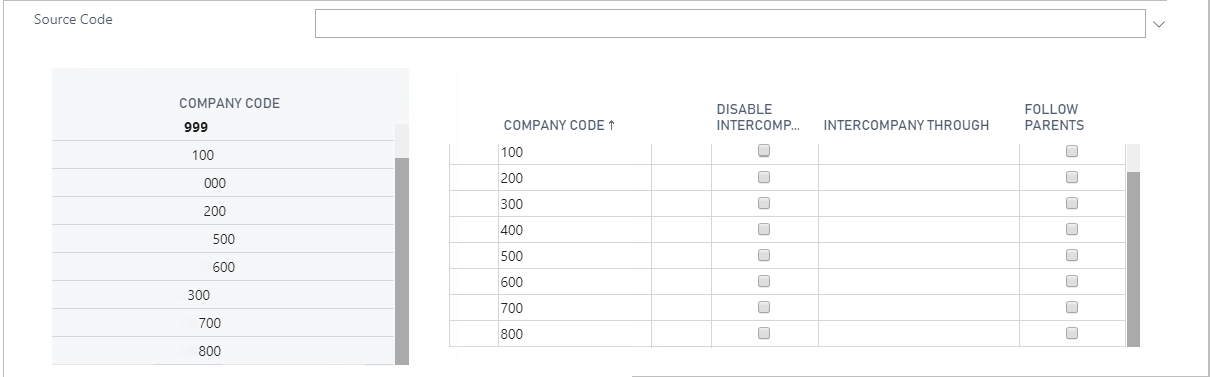

Ex3: Getting the Due To and Due From Accounts Using the Organization Structure Setup

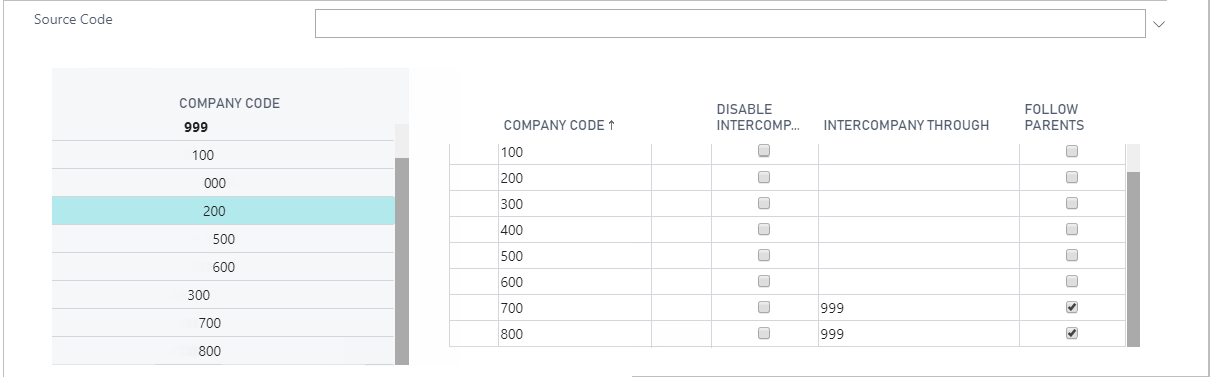

The MEM Organization Structure Setup page is setup as follows:

- Entity 999 is a legal entity has two subentities exist: 100 and 300

- For entity 100, two subentities exist: 000 and 200

- For entity 200, two subentities exist: 500 and 600.

- For entity 300, two subentities exist: 700 and 800.

- For entity 100, two subentities exist: 000 and 200

A transaction is created between entities 200 and 700. The Due To and Due From accounts that are used for the transactions are based on the settings of the Intercompany Through and Follow Parent options:

Scenario 1: Intercompany Through: Empty and Follow Parent: Cleared.

The regular intercompany Due To and Due from accounts are used for a single transaction:

- Originating: 200; Destination: 700

Note: This result is the same as using intercompany setup without organization structure.

Note: This result is the same as using intercompany setup without organization structure.

Scenario 2: Intercompany Through: 999 and Follow Parent: Cleared.

The following intercompany Due To and Due from accounts are used for the following transactions:

- Originating: 200; Destination: 999

- Originating: 999; Destination: 700

Scenario 3: Intercompany Through: 999 and Follow Parent: Selected.

The following intercompany Due To and Due from accounts are used for the following transactions:

- Originating: 200; Destination: 100

- Originating: 100; Destination: 999

- Originating: 999; Destination: 300

- Originating: 300; Destination: 700

Ex4: Disable Intercompany Between Two Entities

Using the following setup:

- Entity 999 is a legal entity has two subentities exist: 100 and 300

- For entity 100, two subentities exist: 000 and 200

- For entity 200, two subentities exist: 500 and 600.

- For entity 300, two subentities exist: 700 and 800.

- For entity 100, two subentities exist: 000 and 200

For entity 200, the Disable Intercompany option is selected for subentities 500 and 600. A payables invoice for originating entity 200 is created. This invoice has expense for entities 200, 500, 000, and 800.

The distributions are as follows:

| Entity Code | Description | Amount |

|---|---|---|

| 800 | Invoice 107212 | 100.00 |

| 200 | Due From 800 | 100.00 |

| 800 | Due To 200 | -100.00 |

| 000 | Invoice 107212 | 300.00 |

| 200 | Due From 000 | 300.00 |

| 000 | Due To 200 | -300.00 |

| 500 | Invoice 107212 | 200.00 |

| 200 | Invoice 107212 | 100.00 |

| 200 | Invoice 107212 | -700.00 |

![]() Note: For the line with entity 500, no Due To and Due From exists between entities 500 and 200.

Note: For the line with entity 500, no Due To and Due From exists between entities 500 and 200.

Ex5: Intercompany Through, Single Holding Entity

Using the following setup:

- Entity 999 is the holding entity has two subentities exist: 100 and 300

- For entity 100, two subentities exist: 000 and 200

- For entity 200, two subentities exist: 500 and 600.

- For entity 300, two subentities exist: 700 and 800.

- For entity 100, two subentities exist: 000 and 200

For entities 700 and 800, Intercompany Through is set to 999 and the Follow Parents option is selected.

A payables invoice for originating entity 200 is created. This invoice has expense for entities 200, 500, and 800.

The distributions without organization structure is as follows are as follows:

| 200-61400 (Office expense) | 100 | ||

| 500-61400 (Office expense) | 200 | ||

| 800-61400 (Office expense) | 300 | ||

| 200-20500 (AP) | 600 | ||

| 200 DUEFROM-500 | 200 | ||

| 200 DUEFROM-800 | 300 | ||

| 500 DUEFTO-200 | 200 | ||

| 800 DUEFTO-200 | 300 | ||

The distributions with organization structure are as follows:

| Entity Code | Description | Amount |

|---|---|---|

| 800 | Invoice 107213 | 300.00 |

| 200 | Due From 999 | 300.00 |

| 999 | Due To 200 | -300.00 |

| 999 | Due From 800 | 300.00 |

| 800 | Due To 999 | -300.00 |

| 500 | Invoice 107213 | 200.00 |

| 200 | Due From 500 | 200.00 |

| 500 | Due To 200 | -200.00 |

| 200 | Invoice 107213 | 100.00 |

| 200 | Invoice 107213 | -600.00 |