In this article

Use this page to enter the revenue allocation parameters for a billing schedule. The revenue allocation can be set up and edited only at the time the billing schedule is created. When viewing this page for an active or terminated billing schedule, all values are read-only.

- When this page is opened for the first time, all line items automatically appear in the Lines area of the form.

- If any changes are made to the billing schedule, the Contract revenue is automatically recalculated. Changes to a billing schedule include the following:

- Changing any of the following areas of a billing schedule line: quantity, unit price, item, frequency, start date, end date, amount, pricing method

- Changing the billing detail: quantity, unit price, amount

- Applying price options including a minimum or maximum

- Terminating or removing a termination on a billing schedule

- Putting a hold on or removing a hold from a billing schedule

- Applying or removing a price adjustment to a billing schedule

- Adding a billing schedule line

- When a line is added to an existing billing schedule, the following occurs:

- If the MEA type for the item is single, the Contract revenue amount is automatically recalculated.

- If the MEA type for the items is multiple, you must select the MEA number before the Contract revenue is recalculated.

Specify Revenue Allocation

Specify the revenue allocation for a billing schedule:

- In the list of all billing schedules, select the Schedule Number of the billing schedule.

- In the In the Actions tab, select Revenue Allocation, which opens the SBS MERA Revenue Allocation (ARCB) page.

- Select the MEA Type.

- Specify the MEA Number and the Deferred Contract Revenue Account.

- If the MEA type is Single, the same MEA Number and Deferred Contract Revenue Account applies to each line.

- If the MEA type is Multiple, you can apply a different MEA number and Deferred contract revenue account to each line.

- In the Actions tab, select Enter Percent Line, which opens the SBS MERA Transaction Percent Line page. Available only when SPP Origin for a line is Percent of item.

- For the item, specify the Percent, and select OK.

- In the SBS MERA Revenue Allocation (ARCB) page, select OK.

Review MEA History

Review the MEA percent history

- In the list of all billing schedules, select the Schedule Number of the billing schedule.

- In the In the Actions tab, select Revenue Allocation, which opens the SBS MERA Revenue Allocation (ARCB) page.

- In the Actions tab, select History.

- In the page that opens review the history, and select Close when you are finished.

Fields

This page contains the following fields:

| Field | Description |

|---|---|

| Document No. | Displays the document number. |

| MEA Type |

The multiple element arrangement (MEA) type for the transaction:

|

| MEA Number |

Displays the MEA number for a line. Available when MEA Type is Single. When this value is empty, and you assign a MEA number, the SSP Origin and Standalone Selling Price are automatically updated based on the values from the SBS MERA Item Standalone Selling Price page. Only the MEA numbers that are assigned to other lines in the billing schedule list are available. This field is read-only when the line has been billed. |

| Deferred Contract Rev. Account |

Specify the account you want to use for journal entries when a multiple element arrangement (MEA) contract invoice is created. Available when Advanced Recurring Contract Billing is installed and used. |

| Line Field and Description | |

| Item No. |

Displays the value from the billing schedule list. |

| Frequency |

Displays the frequency for the revenue allocation: Daily, Monthly, Quarterly, Semiannually, or Annually. |

| Contract Value | Displays the contract value. |

| MEA Number |

Displays the MEA number for a line. Available when MEA Type is Single. When this value is empty, and you assign a MEA number, the SSP Origin and Standalone Selling Price are automatically updated based on the values from the SBS MERA Item Standalone Selling Price page. Only the MEA numbers that are assigned to other lines in the billing schedule list are available. If these values are not set up for the item, the values are from the SBS MERA Multi-Element Revenue Allocation Setup page. |

| SSP Origin |

Displays the standalone selling price origin for the line.

When the option for a child item is changed from percent of parent standard price to invoice price (or vice versa), the calculated values are also updated. |

| Percent | Displays the allocation percentage. |

| Standalone Selling Price |

Displays the standalone selling price for the line in the transaction currency. If SSP Origin is Amount, this value is manually entered. Otherwise, it is automatically calculated. |

| Contract SSP |

Displays the contract standalone selling price. Read-only. Remaining Contract amount: Displays the calculated remaining revenue for the line in the transaction currency. This is the amount that is posted to the revenue account for this line. Remaining Contract revenue = Standalone selling price *Contract revenue Ratio For lines that have an SSP Origin of Percent of item and have percentages specified in the SBS MERA Transaction Percent Line page, the calculated value is the sum of amounts for the lines on the SBS MERA Transaction Percent Line page. |

| Contract Revenue |

Displays the calculated revenue for the line in the transaction currency. This is the amount that is posted to the revenue account for this line. For lines that have an SSP Origin of Percent of item and have percentages specified in the SBS MERA Transaction Percent Line page, the calculated value is the sum of amounts for the lines on the SBS MERA Transaction Percent Line page. |

| Deferred Contract Rev. Account |

Specify the account you want to use for journal entries when a multiple element arrangement (MEA) contract invoice is created. Available when Advanced Recurring Contract Billing is installed and used. The default value is from the header, but you can change the value for the line. |

| Error | Displays any errors associated with the revenue allocation. |

| Accruals Tab | |

| MEA Number | Displays the MEA number. |

| Accrued Amount | Displays the total accrued revenue amount for the MEA number. |

| Deferred Contract Rev. Account |

Specify the account you want to use for journal entries when a multiple element arrangement (MEA) contract invoice is created. Available when Advanced Recurring Contract Billing is installed and used. The default value is from the header, but you can change the value for the line. |

Actions

The following actions are available:

| Action | Description |

| History |

|

| Enter Percent Line |

|

Example

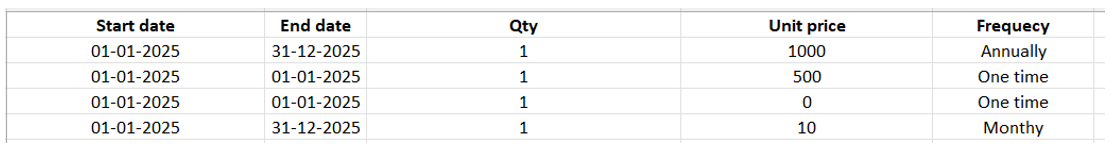

-

Create 4 billing schedule lists with mentioned details.

Total contract amount for above line is 1620.

-

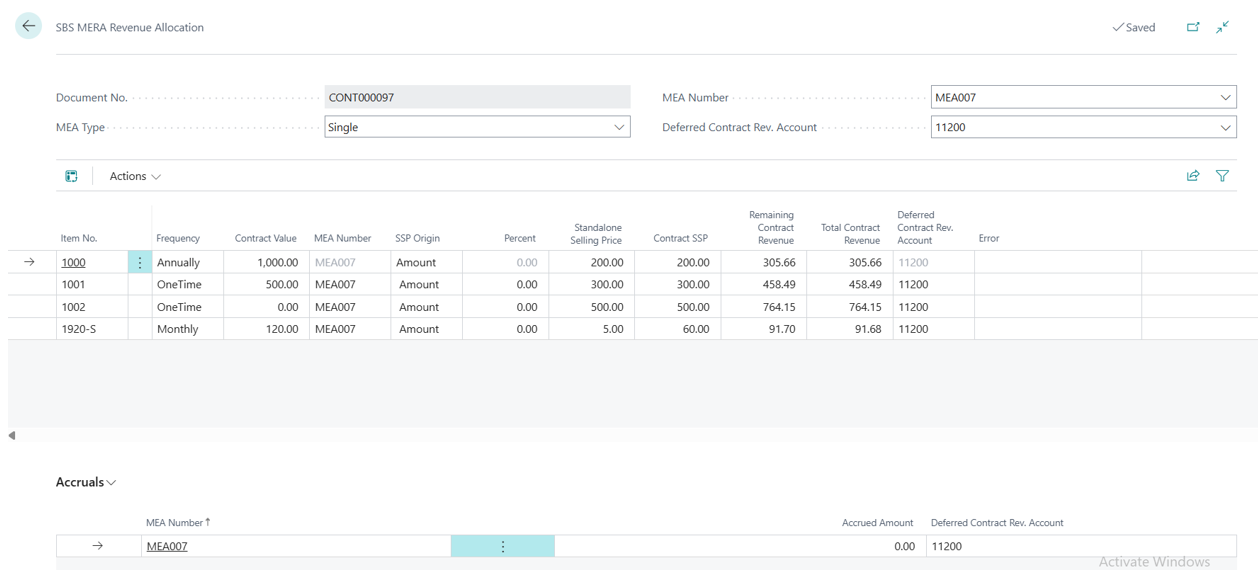

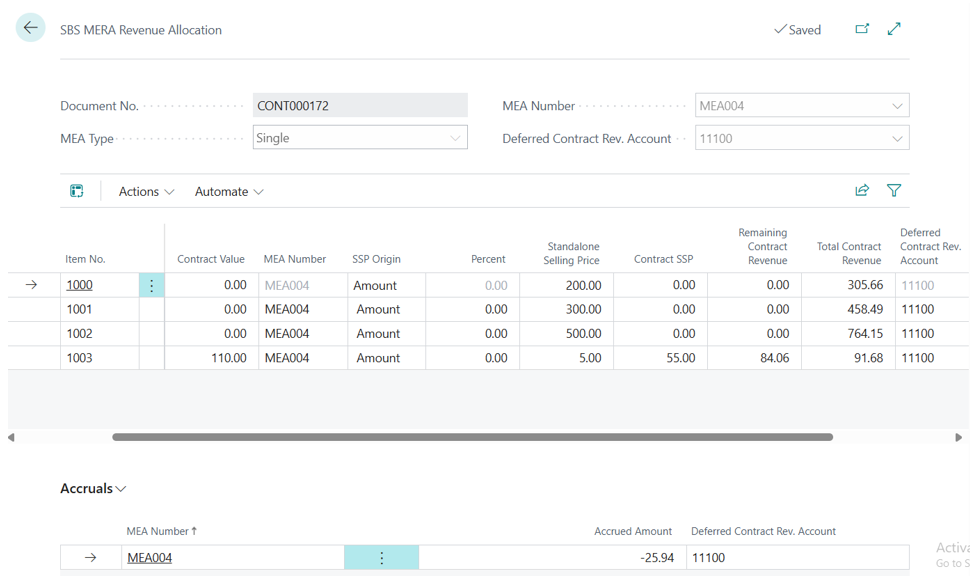

Select Revenue Allocation in the Header to be redirected to the SBS Mera Revenue Allocation template.

-

Set the MEA Type to Single.

-

Choose the MEA Number (the template created by the user).

-

The Deferred Contract Revenue Amount account will auto-populate based on the selected template.

-

Navigate to the line item and select the SSP Region as shown in the screenshot above.

-

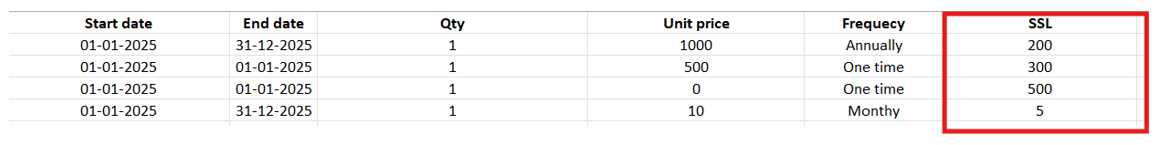

Enter the Standalone Selling Price for each line item, as shown below.

The total of Standalone Selling price is 1060: (200+300+500+(5*12)).

Note: As the final item's frequency is monthly, the system multiplies its value by 12 (e.g., 5 * 12 = 60).

Note: As the final item's frequency is monthly, the system multiplies its value by 12 (e.g., 5 * 12 = 60). -

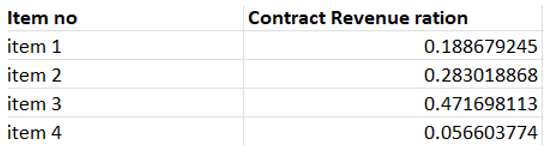

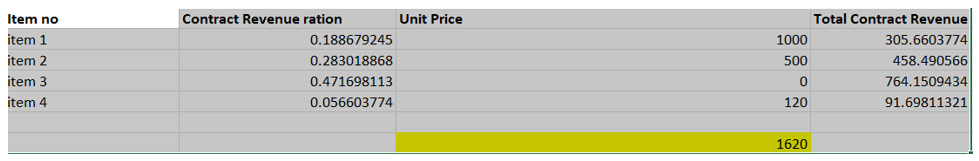

The Total Contract Revenue must now be defined, which requires the calculation of a Contract Revenue Ratio for each item.

The ratio is calculated as: (Standalone Selling Price of the Item) / (Total of All Standalone Selling Prices).

For example, for Item 1, the calculation is 200 / 1060 = 0.188679245.

Consequently, the values for each item should be populated as follows:

The Total Contract Revenue for a line is calculated using the formula:

(Contract Revenue Ratio) × (Total Contract Amount)

Where the Total Contract Amount is the sum of all item unit prices.

For example, for Item 1: 0.18867 × 1620 = 305.6603.

The remaining items can be calculated in the same way, as shown below.

-

The Total Contract Remaining Amount will remain unchanged until an invoice is generated.

-

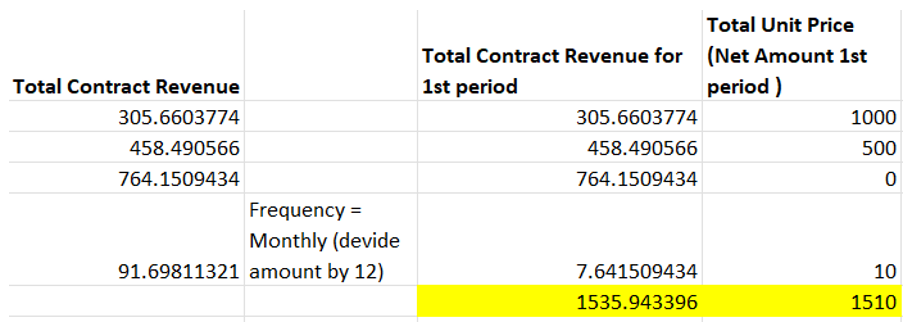

Navigate to the Billing Schedule, access the Invoice Creator, and generate the invoice for the January period covering all items. Once the invoice is posted, the remaining amount will reflect the updated values shown below.

-

Verify the Accruals amount.

The Total Contract Revenue is as shown below.

Accrual Calculation: (Total Net Amount) - (Total Calculated Revenue Allocation)

= 1535.943396 - 1500

= 25.94

Note: The Sales Invoice will show this value as negative: -25.94.

Note: The Sales Invoice will show this value as negative: -25.94.