VAT Posting Groups

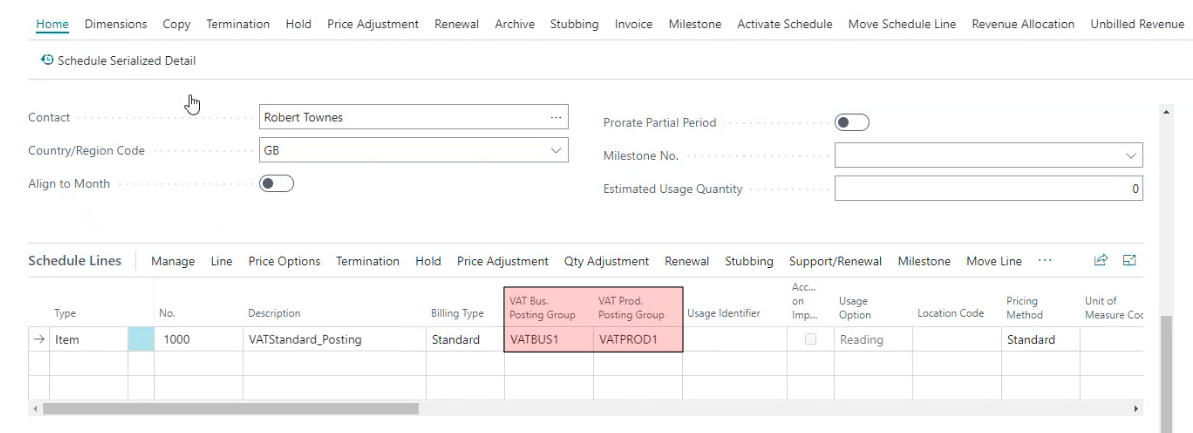

GST/VAT Product Posting Group per Billing Schedule Line

When you create a Sales Invoice (out of the box), you can create the VAT Business Posting Group, which comes from the customer setup screen, and the VAT Product Posting Group, which comes from the item setup screen. These two fields are populated by default, and their values are transferred to the posted invoice. We want to implement that functionality in SBS, so those two columns have been added.

-

VAT Business Posting Group: Specifies the vendor's tax specification, to link transactions made for this vendor with the appropriate general ledger account, according to the tax posting setup.

-

VAT Product Posting Group: Links business transactions made for the item, resource or G/L account with the general ledger, to account for VAT amounts resulting from trade with that record.

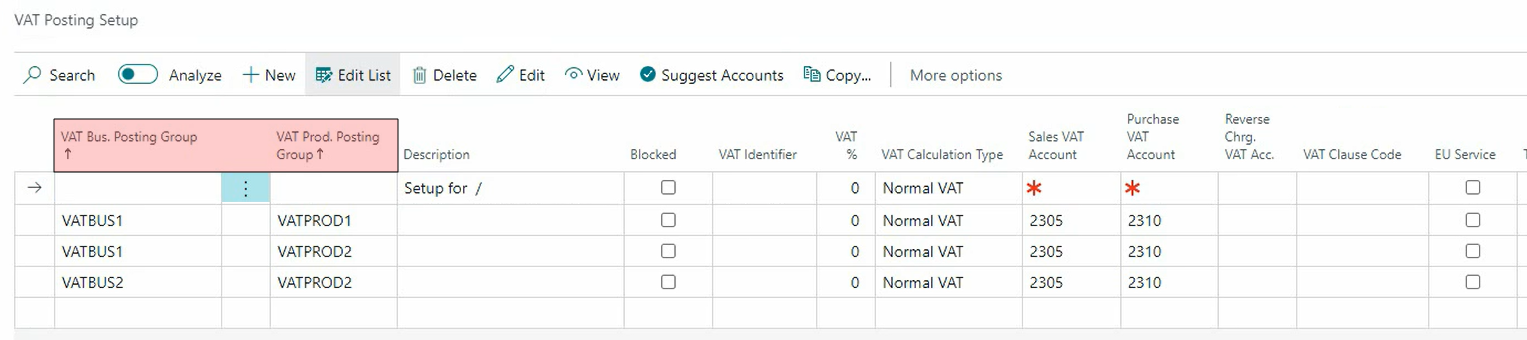

First, we need to define the default values for both the VAT Business and VAT Product fields, entered in the VAT Posting Setup screen (below). If values aren't entered, then an error will be generated if you try to use this functionality.

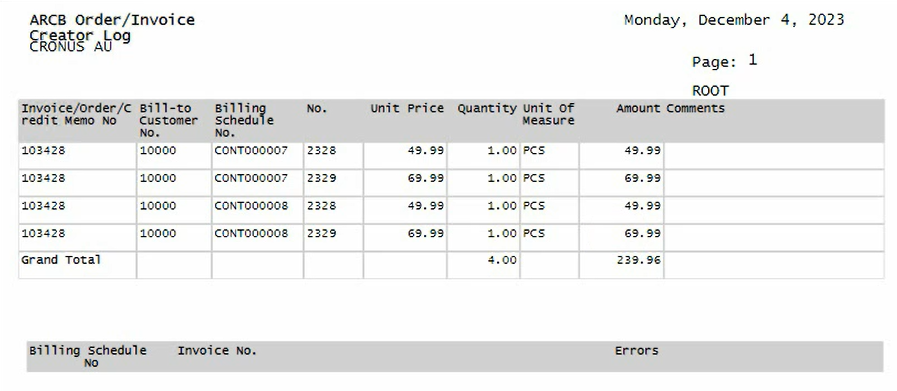

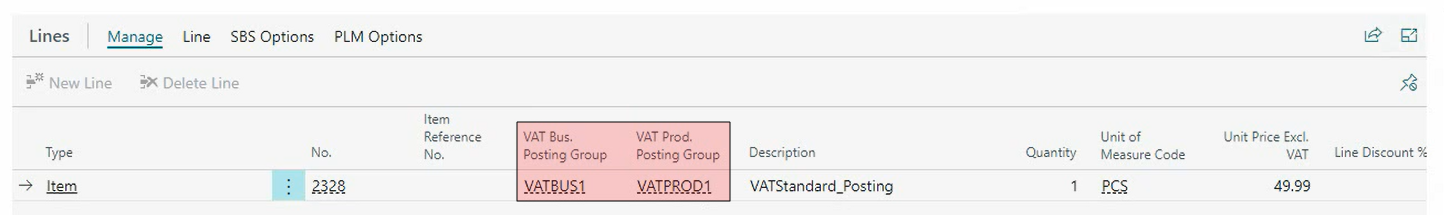

These VAT values will be present in the posted invoice, as shown here.

Invoice Consolidation

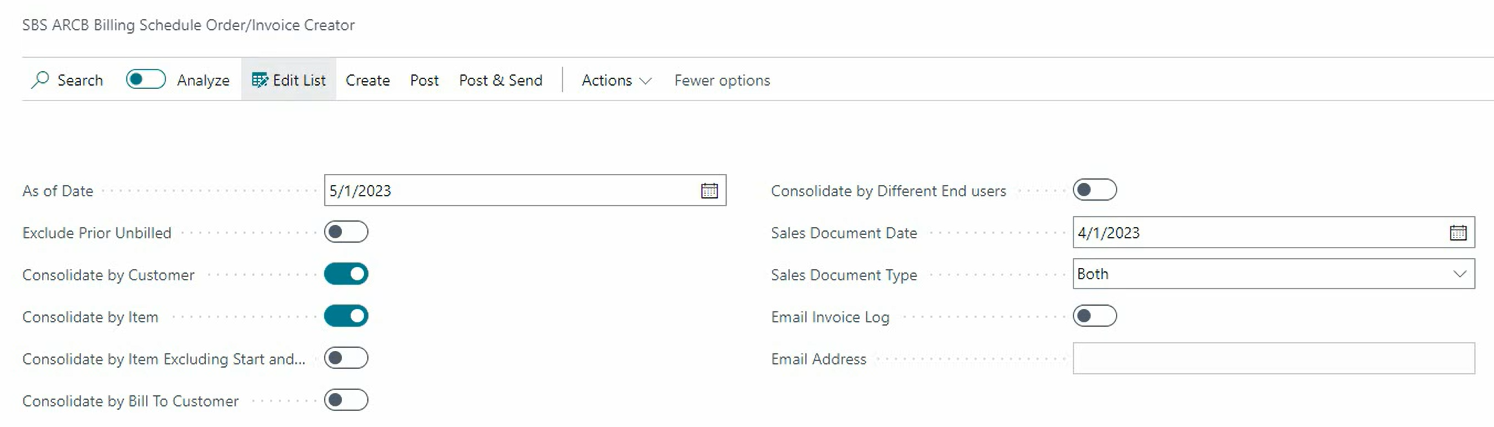

You can also consolidate the customers and/or items when creating multiple invoices. In this example, both the customers and the items are consolidated, by enabling the Consolidate by Customer and Consolidate by Item switches.

In this example, the invoices belong to the same customer and to the same Product Posting Group. As a result, the items are consolidated and only a single invoice is created.