In this article

Use this page to process the recognition for several deferral lines for multiple deferral schedules.

![]() Tip: To process the recognition of lines for a single deferral schedule, use the SBS ARED Deferral Schedule Line Recognition page.

Tip: To process the recognition of lines for a single deferral schedule, use the SBS ARED Deferral Schedule Line Recognition page.

Recognize Revenue for Deferral Schedules

To recognize revenue for several deferral schedules, follow these steps:

- Open the SBS ARED Batch Recognition Process page.

- Specify the header options as needed.

- Select the lines that you want to process.

- In the Actions tab, select Process > Recognize or Recognize.

- When you are asked to confirm the action, select Yes.

In particular, specify the Recognition Journal Template and Recognition Journal Batch.

Display Report After Recognize

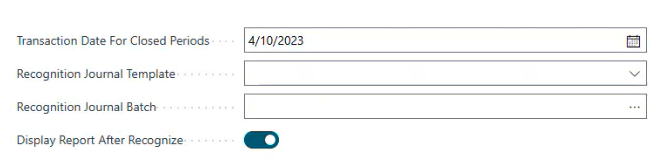

A Display Reports After Recognize toggle button has been added to this screen. This button is switched on by default.

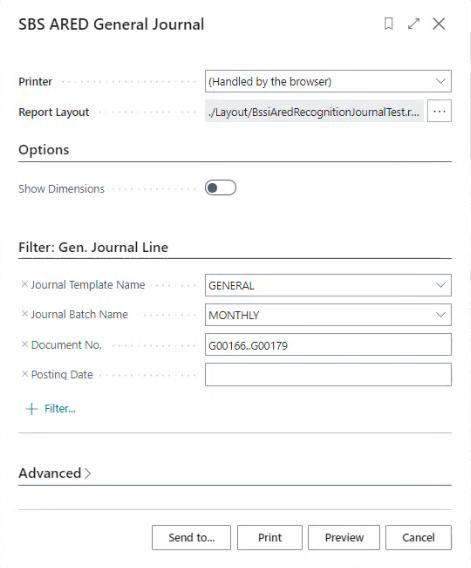

After selecting multiple billing schedules and running them in a batch (by pressing the Recognize button):

Button disabled: The report is generated, but it is not displayed. It also won't populate any of the messages.

Button enabled: After the report is generated, the report options screen will be displayed, as shown here:

Fields

This page contains the following fields:

| Field | Description |

| Cutoff Date |

Specify the cut off date on which to include lines for processing in the list. The list shows all lines that have a deferral end date on or before the cutoff date. For the lines that appear in the list, you can select which lines you want to run the recognition process. |

| Description |

Specify a description of the journal that is created. |

| Summarize Recognition Journal |

Indicates whether recognition vouchers are consolidated:

The default value is from the SBS ARED Advanced Revenue & Expense Deferrals Setup page. |

| Override Transaction Date |

Indicates whether the transaction date is to be overridden with the transaction date specified on this form:

By default, the date used on the journal voucher is the end date of the deferral schedule line. |

| Transaction Date |

Specify the date on which the recognition voucher is posted for all deferral scheduled lines. Available when Override Transaction Date is

|

| Transaction Date for Closed Periods |

Specify the transaction date for deferral schedule lines that are not in an open or valid period. This date must be within an open fiscal period. Available when Override Transaction Date is |

| Journal Template for Recognition |

Select the template for recognition journal entries. The default value is from the SBS ARED Advanced Revenue & Expense Deferrals Setup page. |

| Journal Batch for Recognition |

Select the template for the recognition batch journal entries. The default value is from the SBS ARED Advanced Revenue & Expense Deferrals Setup page. |

| Display Reports After Recognize | On: After the report is generated, the report options screen will be displayed. Off: After the report is generated, the report option screen will not displayed. It also won't populate any of the messages. |

| Lines | |

| Schedule No. |

Displays the deferral schedule number. |

| Line No. |

Displays the sequential line number. |

| Deferral Start Date |

Displays the start date of the deferral schedule. |

| Deferral End Date |

Displays the end date of the deferral schedule. |

| Expiration Date |

Displays the expiration date. |

| Amount |

Displays the deferral amount. |

| Recognized |

Displays whether the line has been recognized or not. |

| Stubbed |

Displays whether the line has been stubbed or not. |

| Item No. |

Displays the item number. |

| Recognition Account |

Displays the account used for the recognition amount. |

| Deferral Account |

Displays the account used for the deferral amount. |

| Transaction Date of Line |

Displays the transaction date. |

| Discount Amount |

Displays the Line Discounts amount. |

| Invoice Discount Amount |

Displays the Invoice Discounts amount. |

| COGS Amount |

Displays the Item Cogs amount. |

| Customer No. |

Displays the Billing Schedule Customer number. |

| Customer/Vendor Name |

Displays the Billing Schedule Customer/Vendor name. |

| Totals | |

| The column totals show the sum of the schedule lines for each category of amounts: recognition, discount, and COGS. | |

| Recognition Amount | Displays the total recognition amount for all lines. |

| Expiration Amount | Displays the total expiration amount for all lines. |

| Total Amount | Displays the total amount of all lines. |