In this article

Terminating a Billing Schedule: Unbilled Revenue Examples

Review the following examples to better understand termination for billing schedules that use the unbilled revenue feature.

Adjust schedule with Full Refund

A billing schedule has the following settings:

- Start date: January 1, 2019

- End date: December 31, 2019

- Amount: 1,200.00

- Frequency: Annual

A deferral schedule for 1,200.00 is also created, and revenue is recognized until May 31.

The contract is terminated on December 31, 2018, which is before the billing start date. As a result, a full credit is issued.

Before the contract is terminated, the following transactions occur.

| Initial journal entry | |||

| Unbilled Revenue | 1200.00 | ||

| Revenue or Deferred Revenue | 1200.00 | ||

| Billing Invoice | |||

| AR | 1200.00 | ||

| Unbilled Revenue | 1200.00 | ||

| Revenue recognition from January to May is 496.44 (fiscal periods) | |||

| Deferred Revenue | 496.44 | ||

| Revenue Recognition | 496.44 | ||

When the contract is terminated the following transactions occur. The settings are as follows:

- Termination date: December 31, 2018

- Termination type: Adjust schedule

| Issue credit: A credit is issued for 1,200.00 | |||

| Unbilled Revenue | 1200.00 | ||

| AR | 1200.00 | ||

| Adjust or Reverse the journal entry: Total amount - Billed amount + credit = 1200 - 1200 + 1200 = 1200.00 | |||

| Deferred Revenue | 1200.00 | ||

| Unbilled Revenue | 1200.00 | ||

| If the item is not deferrable | |||

| Revenue | 1200 | ||

| Unbilled Revenue | 1200 | ||

| Deferral schedule adjustment: True up could be up or down | |||

| Total - Recognized - Adjustment = 1200 - 496.44 - 1200 = (496.44) in the next available period | |||

| Revenue Recognition | 496.44 | ||

| Deferred Revenue | 496.44 | ||

Adjust schedule with Partial Refund

A billing schedule has the following settings:

- Start date: January 1, 2019

- End date: December 31, 2019

- Amount: 1,200.00

- Frequency: Quarterly

An unbilled revenue journal entry and a deferral schedule for 1,200.00 is also created. The first two invoices have been generated and on May 31 the contract is terminated.

Before the contract is terminated, the following transactions occur.

| Initial journal entry | |||

| Unbilled Revenue | 1200.00 | ||

| Revenue or Deferred Revenue | 1200.00 | ||

| Billing Invoice | |||

| January 1 | |||

| AR | 300.00 | ||

| Unbilled Revenue | 300.00 | ||

| April 1 | |||

| AR | 300.00 | ||

| Unbilled Revenue | 300.00 |

Revenue recognition from January to May is 496.44 (fiscal periods). This amount is not the same as the billed amount 500.00 until May.

When the contract is terminated the following transactions occur. The settings are as follows:

- Termination date: December 31, 2018

- Termination type: Adjust schedule

The refund for the advanced billing is calculated as follows:

- Total invoiced amount - Amount until termination date = 600 - 500 = 100.00

| Issue credit: A credit is issued for 100.00 | |||

| Unbilled Revenue | 100.00 | ||

| AR | 100.00 | ||

| Adjust or Reverse the journal entry: Total amount - Billed amount + credit = 1200 - 600 + 100 = 700.00 | |||

| Deferred Revenue | 700.00 | ||

| Unbilled Revenue | 700.00 | ||

| If the item is not deferrable | |||

| Revenue | 700.00 | ||

| Unbilled Revenue | 700.00 | ||

| Deferral schedule adjustment: True up could be up or down | |||

| Total - Recognized - Adjustment = 1200 - 496.44 - 700 = (3.56) in the next available period | |||

| Revenue Recognition | 496.44 | ||

| Deferred Revenue | 496.44 | ||

Deferral schedule adjustment: True up could be up or down

- Total - Recognized - Adjustment = 1200 - 496.44 - 700 = 3.56

Bill remaining with No Refund

A billing schedule has the following settings:

- Start date: January 1, 2019

- End date: December 31, 2019

- Amount: 1,200.00

- Frequency: Quarterly

A deferral schedule for 1,200.00 is also created. The first invoice for the first quarter is created. On March 20, the contract is terminated.

Before the contract is terminated, the following transactions occur.

| Initial journal entry | |||

| Unbilled Revenue | 1200.00 | ||

| Revenue or Deferred Revenue | 1200.00 | ||

| Billing Invoice | |||

| January 1 | |||

| AR | 300.00 | ||

| Unbilled Revenue | 300.00 |

Revenue recognition from January until March is 295.89.

When the contract is terminated the following transactions occur. The settings are as follows:

- Termination date: March 20, 2019

- Termination type: Bill Remaining

A sales order is created for the remaining amount of 900.00.

| Sales order | |||

| AR | 900.00 | ||

| Unbilled Receivables | 900.00 |

The sales order is a sum of all remaining periods and will appear on the next invoice.

If the billing schedule has a corresponding deferral schedule, the revenue (295.89) is recognized until March 31. The revenue recognition is for the remaining amount in the next available period 4/1, 2019.

| Deferred Revenue | 904.11 | ||

| Revenue Recognition | 904.11 |

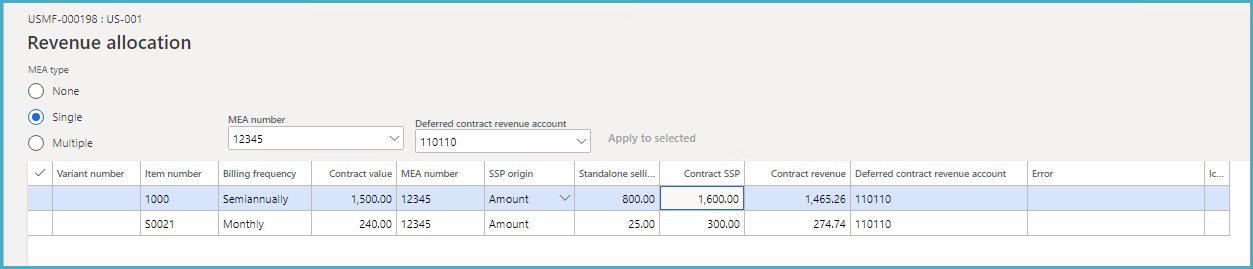

Revenue Allocation

When an item that uses revenue allocation is terminated, the contract revenue amount of all items that belong to the same MEA number are updated. Review the following example to better understand the termination process.

For example, Item 1000 is added to a billing schedule with the following details:

- Item 1000 is billed semiannually:

- 750.00 for 2 times per year

- Standalone selling price is 800.00

- Before termination, the contract revenue is 1,465.25

- The insurance item S0021 has a contract revenue of 274.74

The billing start date is January 01, 2020 and the end date is December 31, 2020.

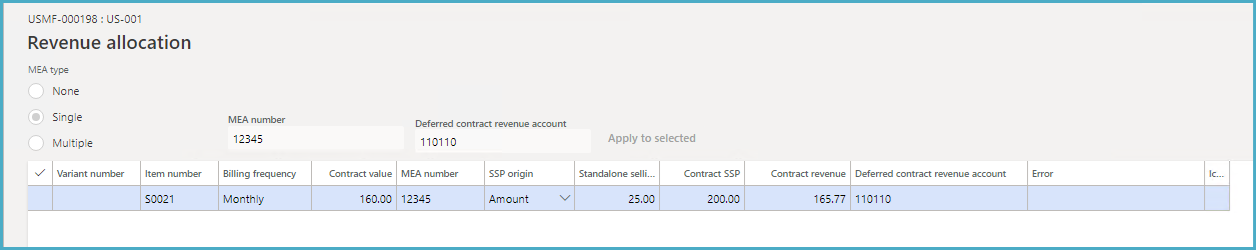

A billing line for Item 1000 is terminated on June 30, 2020. The other billing line for Item S0021 that belongs to the same MEA is still active and will be billed until the end of the term. With the line termination, the contract revenue amount is reduced to 165.77. The secondary item has the journal entry created, and it must be adjusted accordingly.

- The original journal entry for 274.74 is reversed.

- A new journal entry for 165.77 is created.

- The adjustment appear on the Unbilled Revenue Journal Entry Audit.