In this article

Escalation and Discount

Modules > Advanced recurring contract billing > Billing schedules > All or Active billing schedules > [select a billing schedule line] > [select Escalation and discount]

Modules > Advanced recurring contract billing > Billing schedules > All or Active billing schedules > [select a billing schedule] > [select Escalation and discount]

Modules > Advanced recurring contract billing > Billing schedules > All or Active billing schedules > [select a billing schedule] >[select a billing schedule line] > [select Escalation and discount]

Use this page to apply and process an escalation or discount for a billing schedule or a billing schedule line.

- An escalation is a price increase for a future billing period where the invoice has not yet been created.

- A discount is a price reduction for a future billing period where the invoice has not yet been created.

Escalations and discounts cannot be applied to a billing schedule retroactively. For example, you wanted to apply and process an escalation to a billing schedule three months in the past. In Property Lease Management, it is not possible to "catch up" on a price increase that was to happen three months ago.

You can apply the escalation or discount to a billing schedule or billing schedule line in one of the following ways:

- from the All/Active Billing Schedules list

- to the billing schedule displayed on the Billing Schedules

- to a specific billing schedule line on the Billing Schedule Lines

Discount for Unbilled Revenue Journal Entries

The total discount amount is calculated based on the specified discount amount or percentage between the start and end dates. The end date is a required value, and when the initial journal entry and deferral schedule for a discount are created, the distribution is as follows.

Distribution for initial journal entry for discount:

| Deferred Discount account | DR | ||

| Unbilled Discount account | CR |

Deferral Item

The distribution for a deferral schedule discount is as follows:

| Discount Recognition account | DR | ||

| Deferred Discount account | CR |

The deferral schedule uses the same start and end dates as the discount. The discount line is updated with the newly created initial journal entry and the deferral schedule.

The distribution for the invoice that is created is as follows:

| AR | DR | ||

| Unbilled Discount account | DR | ||

| Unbilled Revenue account | CR |

Example: Unbilled Revenue

Review the following distribution to understand how discounts work with the unbilled revenue feature:

| Deferred Item | ||||

| Contract | 1200.00 | 1-year | ||

| -240.00 | 20% discount | |||

| 960.00 | ||||

| Initial Journal entry for Revenue Amount | ||||

| DR | CR | |||

| Unbilled Revenue | 1200.00 | |||

| Deferred Revenue | 1200.00 | |||

| Initial Journal entry for Revenue Amount | ||||

| Deferred Discount | 240.00 | |||

| Unbilled Discount | 240.00 | |||

| Revenue Recognition | ||||

| Revenue Schedule | ||||

| Deferred Revenue | 100.00 | |||

| Revenue/Recognition Account | 100.00 | |||

| Discount Schedule | ||||

| Discount Recognition Account | 20.00 | |||

| Deferred Discount | 20.00 | |||

| Billing | ||||

| AR | 80.00 | |||

| Unbilled Discount | 20.00 | |||

| Unbilled receivable | 100.00 | |||

| Non-Deferred Item | ||||

| Contract | 100.00 per month with a 20% discount | |||

| Initial Journal entry | N/A | |||

| Revenue Recognition | N/A | |||

| Billing | ||||

| DR | CR | |||

| AR | 80.00 | |||

| Discount Account | 20.00 | |||

| Revenue/Sales Account | 100.00 | |||

Revenue Splitting: Escalation with Items

When journal entries for items that use revenue splitting are processed, each item must be adjusted because the contract revenue of each item changes when the escalation is applied. The journal entries are adjusted with the current date as the recalculation date.

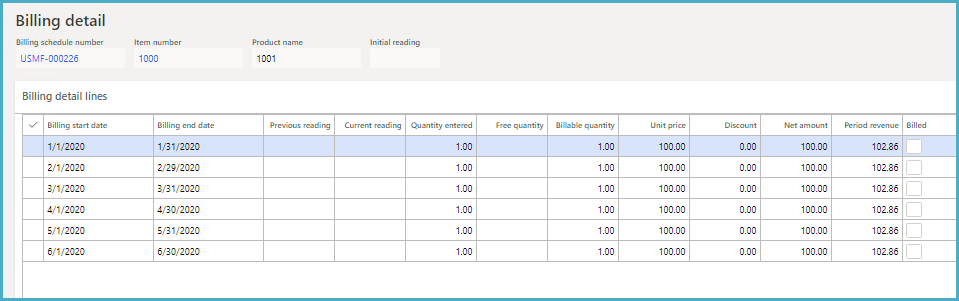

For example, Item 1000 is added to a billing schedule and is sold with insurance (Item S0021) with the following details:

- Item 1000 is billed monthly:

- 100.00 for 6 months

- Standalone selling price is 150.00

- Contract revenue is 617.16

The following image shows the billing details for this item. The period revenue for each month is 102.86.

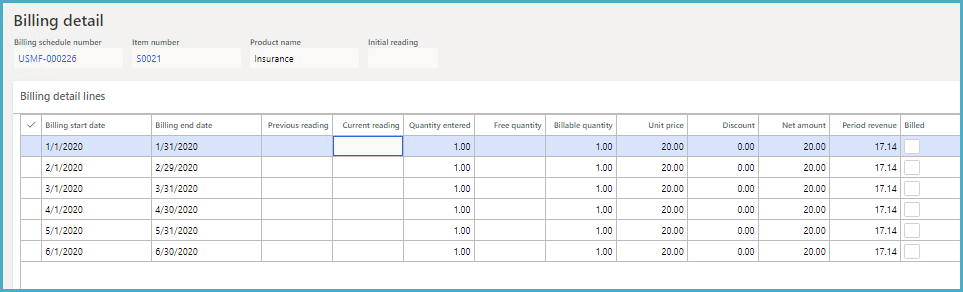

- Insurance item S0021 is billed monthly:

- 20.00 for 6 months

- Standalone selling price is 25.00

- Contract revenue is 102.84

The following image shows the billing details for this item. The period revenue for each month is 17.14.

After the initial journal entry is created, the escalation is applied to some of the billing periods for Item S0021, from March 2020 until the end of the contract. In addition to increasing the contract revenue of this item, the contract revenue of all billing lines that belong to the same MEA number must also be increased. When the escalation is applied, the journal entries for the lines are processed as follows:

- Reverse the journal entry of the main item.

- Create new journal entry for the main item.

- Reverse the journal entry of the secondary item.

- Create new journal entry for the secondary item.

Apply Escalation or Discount

To apply an escalation or discount to a billing schedule, follow these steps:

- Select a billing schedule or a billing schedule line:

- From the All/Active Billing Schedules list, select a billing schedule

- When you are in the Billing Schedules page reviewing a specific billing schedule

- In the Billing Schedules form, in the Billing schedules lines section select a line

- Select Escalation and discount.

- Select the CPI index calculation for the escalation or discount.

- For each escalation or discount line you add, do the following:

- Select New.

- For a discount, select the Discount check box.

For an escalation, leave the check box cleared. - Specify the Start date and select the Frequency.

- For deferral items that use the unbilled revenue feature, specify the End date.

- Specify the Percentage, Amount, or CPI schedule for the escalation or discount.

- Specify the End date.

- Select OK.

Fields

This page contains the following fields:

| Field | Description |

| Item number | Displays the item number for the billing schedule line. Available when this page is opened for a billing schedule line item. |

| CPI index calculation |

Select to determine the method used for the CPI escalation calculation:

|

| Line Grid | |

| Discount |

Select whether the change in the amount is an escalation or discount:

This value cannot be edited for items that use the unbilled revenue feature. Also, discounts cannot be applied to items that use revenue splitting. |

| Start date |

Select the start date for the escalation or discount. |

| Frequency |

Select the frequency of the escalation or discount: None, Monthly, Quarterly, Semiannually, or Annually. |

| Percentage | Specify the percentage for the escalation or discount. |

| Amount |

Specify the escalation or discount amount. |

| CPI schedule |

Select the CPI schedule that is used for the calculations. |

| End date |

Select the end date for the escalation or discount. This value is required for items that use the unbilled revenue feature. |

| Deferral schedule number |

Displays the deferral schedule number. Available only when this page is opened from the billing schedule line level. |

| Journal batch number |

Displays the journal batch number. Available only when this page is opened from the billing schedule line level. |

| Total discount amount |

Displays the total sum of the discount amount for all lines in the grid. Available only when this page is opened from the billing schedule line level. |

| Current short-term unbilled revenue amount |

Displays the current short-term unbilled revenue amount. This amount appears only when the a short-term deferral method is selected on the Advanced Recurring Contract Billing Parameters page and the accounts are set up on the Unbilled Revenue Setup page for the line item. |

| Current long-term unbilled revenue amount |

Displays the current long-term unbilled revenue amount. This amount appears only when the a short-term deferral method is selected on the Advanced Recurring Contract Billing Parameters page and the accounts are set up on the Unbilled Revenue Setup page for the line item. |

| Audit | |

| Old amount | Displays the original amount of the discount journal entry. |

| New amount | Displays the new amount of the discount journal entry. |

| User modified | Displays the user ID of the user who made the change. |

| Modified date | Displays the date on which the change is made. |

| Comment | Displays the comment specified for the change. |

| Old journal number | Displays the journal entry number for the original transaction. |

| Reversal Journal number | Displays the journal entry number reversal transaction. |

| New journal number | Displays the journal entry number for the new transaction. |

Buttons

This page contains the following buttons:

| Button | Description |

| Process |

Saves any changes, rolls down any escalations or markdowns to all active billing schedule lines that have the Escalation check box selected, and processes the escalation or discount on the billing schedule or billing schedule line. |

| Close | Saves any changes and closes the page without processing the escalation or discount. |