In this article

Unbilled Revenue: Examples

Use the unbilled revenue feature when you want to recognize the entire amount of a contract on the balance sheet as unbilled revenue. The other side of the entry is charged to either a revenue or deferred revenue account, depending on the accounting requirements for the transaction. When you recognized unbilled revenue in this way, the customer invoices draw down the unbilled amount and update accounts receivable. No revenue recognition happens at the time of invoicing as the revenue was either recognized when the unbilled amount was posted or will be recognized based deferral recognition schedule that was set up.

Processing Unbilled Revenue

Review the following example to better understand the unbilled revenue functionality.

Assume a customer signs a 3-year 390.00 contract on January 1 of the current year. The contract includes two parts, licenses and a maintenance agreement.

- Assume the sales price of the license portion is 300.00 and that the customer will be invoiced 100.00 on January 1 of each contract year. The 300.00 license fee will be taken as revenue when the contract is signed.

- The sales price of the maintenance fee is 90.00, and the customer will be invoiced 30.00 on January 1, for each of the upcoming years. The 90.00 maintenance fee will be deferred with 2.50 being recognized each month over the life of the contract.

The customer will be invoiced 130.00 at the beginning (January 1st) of each of the 3 years of the contract.

- Assuming the two items already exist as released products, your first step is to ensure the two items are set up as unbilled items. Use the Unbilled Revenue Setup to set up the items that use the unbilled revenue feature by default and the accounts that are used when the items are added to the billing schedule.

- In the example, the maintenance fee is deferred. The item requires a deferral template, which is set up on the Deferral Templates. The template needs a Monthly period frequency and a recognition period length of 36 months. As a result, the revenue per month will be 2.50.

- Set the Maintenance Fee as a Deferrable item (see Deferrable Items). This step and the next step for Deferral defaults will cause the Maintenance Fee item to be deferred by default when it is sold or included on a billing schedule.

- Set the Deferral Defaults for the maintenance fee. The maintenance fee item will be linked to a 36-month deferral schedule.

- Next create a billing schedule with the two unbilled items on it. The billing schedule for the contract is set up with the following items:

| Item | Start Date | End Date | Amount | Billing Frequency | Deferral Item | Unbilled Revenue | Description |

| License | January 01, CY | December 31 CY+2 | 100.00 | Annually | No | Yes | The customer will be invoiced 100.00 each year. The 300.00 total will be recorded upfront as unbilled revenue on the balance sheet and as revenue on the profit and loss. Each invoice will reduce the unbilled amount. |

| Maintenance | January 01, CY | December 31 CY+2 | 30.00 | Annually | Yes | Yes | The customer will be invoiced 30.00 each year. The 90.00 total will be recorded upfront as unbilled revenue and deferred revenue on the balance sheet. Each invoice will reduce the unbilled amount. The deferred revenue will be recognized monthly over 36 months. |

- On the Billing Schedules page, use the Create unbilled revenue initial journal entry action to post the contract value to the balance sheet as unbilled revenue. It will create two journal entries, one for each line on the billing schedule:

| Account | Debit | Credit | |

| Unbilled Revenue account | 300.00 | ||

| License Revenue account | 300.00 | ||

| Account | Debit | Credit | |

| Unbilled Revenue account | 90.00 | ||

| Deferred Maintenance Revenue | 90.00 | ||

- The contract requires that the invoice for the customer to be created at the beginning of each year. Use the Invoice Creator to create the invoice. When the invoice is created, the journal entry is as follows:

Notice the first journal entry is posted to a revenue account and the second is posted to a deferred revenue account.

| Account | Debit | Credit | |

| AR | 130.00 | ||

| Unbilled Revenue account | 130.00 |

- In the last step, the recognition journal entry is created each month to recognize the deferred maintenance fee revenue. The journal entry can be created using the Recognition Processing page or the Recognize action for the lines on the Schedules pages.

This same journal entry will be created by invoices posted at the beginning of the next two years.

| Account | Debit | Credit | |

| Deferred Maintenance Revenue | 2.50 | ||

| Maintenance Revenue | 2.50 |

This journal entry will be created each time the recognition process is run for this deferred item (a total of 36 times).

Short-Term: Fixed Year

The unbilled revenue feature can be used with the short-term functionality. Review the following example to better understand the calculations that occur when the unbilled revenue feature is used with the fixed year short-term calculation method.

A billing schedule with the following criteria is created:

- Start Date: June 01, 2020

- End Date: December 31, 2021

- Unit Price: 100.00

- Frequency: Monthly

On the Billing Schedules page, the initial journal entry is created from the header action (Unbilled revenue processing > Create Unbilled revenue journal entry). The current short-term and long-term amounts are calculated as followings:

- Current short-term unbilled revenue amount: 700.00

- Current long-term unbilled revenue amount: 1200.00

The invoice for the billing period June 01, 2020, to November 30, 2020, is created. The current short-term and long-term amounts are calculated as followings:

- Current short-term unbilled revenue amount: 100.00

- Current long-term unbilled revenue amount: 1200.00

The invoice for the billing period December 01, 2020, to December 31, 2020, is created. The current short-term and long-term amounts are calculated as followings:

- Current short-term unbilled revenue amount: 1200.00

- Current long-term unbilled revenue amount: 0.00

Short-Term: Rolling Periods

The unbilled revenue feature can be used with the short-term functionality. Review the following example to better understand the calculations that occur when the unbilled revenue feature is used with the rolling periods short-term calculation method.

A billing schedule with the following criteria is created:

- Start Date: June 01, 2020

- End Date: December 31, 2021

- Unit Price: 100.00

- Frequency: Monthly

On the Billing Schedules page, the initial journal entry is created from the header action (Unbilled revenue processing > Create Unbilled revenue journal entry). The current short-term and long-term amounts are calculated as followings:

- Current short-term unbilled revenue amount: 1200.00

- Current long-term unbilled revenue amount: 700.00

The invoice for the billing period June 01, 2020, to November 30, 2020, is created. The current short-term and long-term amounts are calculated as followings:

- Current short-term unbilled revenue amount: 1200.00

- Current long-term unbilled revenue amount: 100.00

The invoice for the billing period December 01, 2020, to December 31, 2020, is created. The current short-term and long-term amounts are calculated as followings:

- Current short-term unbilled revenue amount: 1200.00

- Current long-term unbilled revenue amount: 0.00

Items with Revenue Allocation

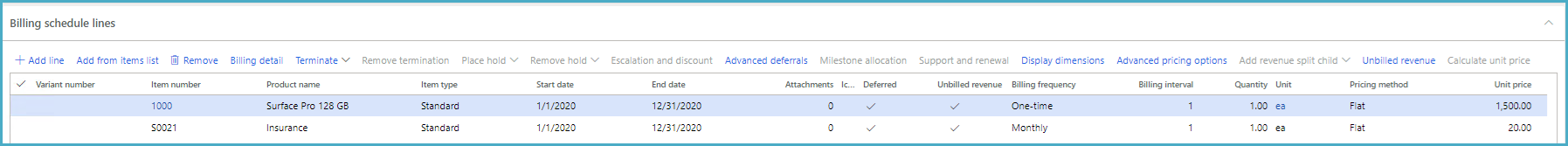

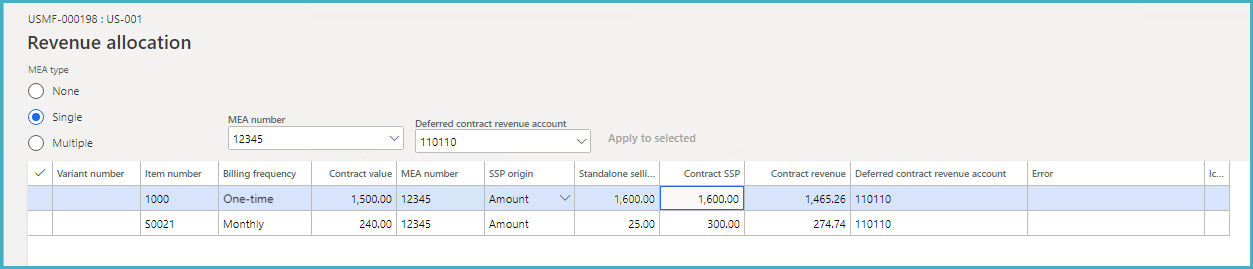

Two items with different billing frequencies are added to a billing schedule. Both use the unbilled revenue feature and are deferrable items.

Surface Pro 128GB (Item number 1000):

- Billing frequency: One-time

- Unit price: 1,500

- Standalone selling price: 1,600

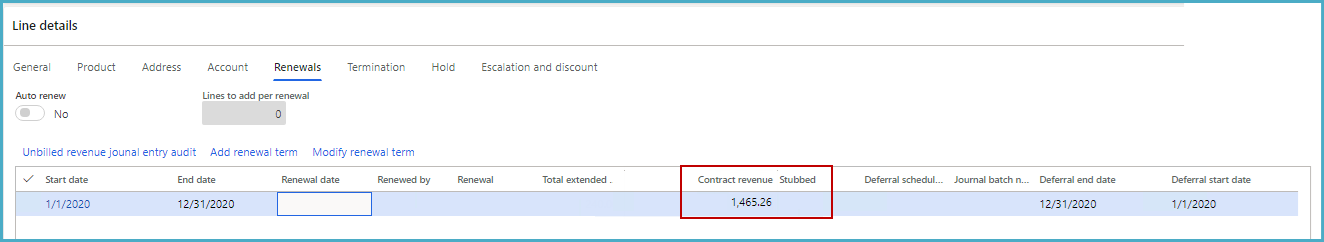

- Contract revenue: 1,465.26

Item 1000 is sold in a bundle with Insurance (Item number S0021):

- Billing frequency: Monthly for 12 months

- Unit price: 20.00 per month

- Standalone selling price: 25.00

- Contract revenue: 264.74

Since both items use the unbilled revenue feature and revenue allocation, the total contract amount on the renewal line is zero (0). Instead, a column called Contract revenue appears and shows the contract revenue amount.

The initial journal entry for the items and the invoice are as follows:

| Account | Debit | Credit | |

| Item 1000 Journal entry | |||

| Debit unbilled revenue account (401250) | 1,465.26 | ||

| Credit deferred revenue account (250600) | 1,465.26 | ||

| Item 0021 Journal entry | |||

| Debit unbilled revenue account (401250) | 274.74 | ||

| Credit deferred revenue account (250600) | 274.74 | ||

| Invoice | |||

| Credit deferred revenue account | 1,465.26 | ||

| Credit deferred revenue account | 274.74 | ||

| Debit AR account (130100) | 1,488.16 | ||

Changes to the billing schedule line, billing detail line, or revenue allocation

When the unit price or quantity is changed, the contract revenue amount for each item that is part of the revenue allocation must be updated. As a result, the journal entry is recalculated.

The unit price for Item 1000 is changed from 1,500 to 1,600. The contract revenue amount is automatically recalculated and become 1,549.47. At the same time, the contract revenue for Item S0021 is recalculated and becomes 290.53.

When the changed is confirmed and committed, the initial journal entries for both items are reversed and new journal entries are created:

- Item 1000: Original initial journal entry of 1,465.26 is reversed. New journal entry for 1,549.47 is created.

- Item S0021: Original initial journal entry of 274.74 is reversed. New journal entry for 290.53 is created.

Termination

Item S0021 that has a start date of January 2020 and end date on December 2020 is terminated on June 2020. The contract revenue amount for both items must be recalculated:

- Contract revenue for Item 1000 becomes 1,567.67.

- Contract revenue for Item S0021 becomes 124.00.

An adjustment journal entry is created for the line that is terminated. The journal entry for the line that belongs to the same MEA number is reversed and a new journal entry is created:

- Item 1000: Original initial journal entry of 1,465.26. An adjustment journal entry for 1,549.47 is created.

- Item S0021: Original initial journal entry of 274.74 is reversed. New journal entry for 124.00 is created.

Revenue Allocation and Renewals

Items that use both the revenue allocation and renewal features must satisfy the following conditions:

- Billing frequency must be a recurring frequency (e.g., Daily, Weekly, Monthly, etc.)

Items that have a billing frequency of One time cannot be renewed. - Billing start and end dates and MEA number must be the same.

These items are renewed together.

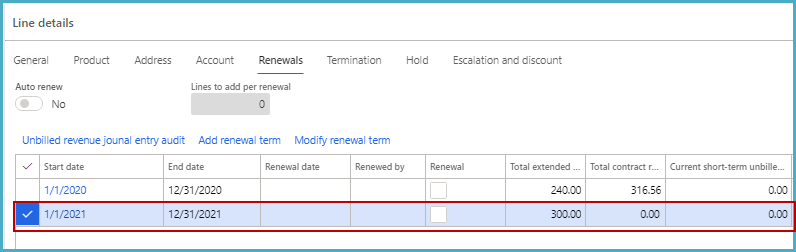

Adding a renewal term

A renewal term can be added at any time during for an active billing schedule. When a renewal term is added, note the following:

- The allocation or renewal total extended amount is zero (no initial allocation). The amount is updated after the invoice for all lines has been created, and the allocation for the renewal term is calculated.

- After the invoice for a line has been created, the new allocation is created based on the lines that have renewal terms.

- If the item does not have a standalone selling price amount, the standalone selling price amount from the previous term is used.

To better understand how the unbilled revenue feature works with items that use both revenue allocation and renewal features, review the following example.

A billing schedule with the following items is created:

| Line | Item | Product name | Billing frequency | Start date | End date | Unit price | Total extended amount | Contract revenue amount |

| 1 | 1000 | Desktop computer | One time | January 01, 2020 | December 31, 2020 | 2,000.00 | 1,846.81 | |

| 2 | S0001 | Insurance | Monthly | January 01, 2020 | December 31, 2020 | 20.00 | 240.00 | 316.56 |

| 3 | S0002 | Software | Monthly | January 01, 2020 | December 31, 2020 | 20.00 | 240.00 | 316.56 |

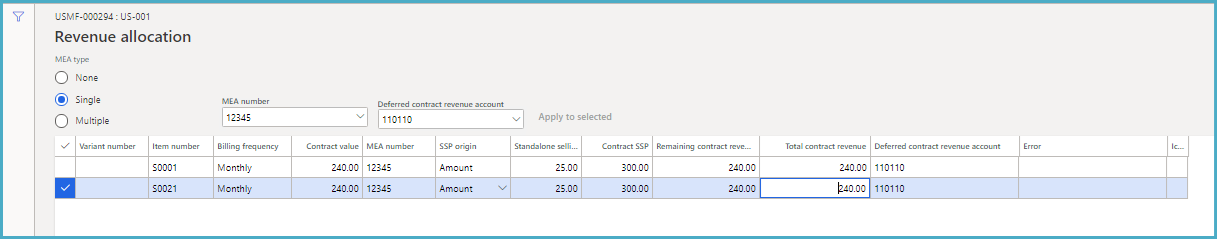

The revenue allocation is as follows:

- MEA type: Single

- MEA number: 12345

- Deferred contract revenue account: 110110

| Item number | Billing frequency | Contract value | MEA number | SSP origin | Standalone selling price | Contract SSP | Total contract revenue | Deferred contract revenue account |

| 1000 | One time | 2,000.00 | 12345 | Amount | 2,100.00 | 2,100.00 | 1,846.81 | 110110 |

| S0001 | Monthly | 240.00 | 12345 | Amount | 30.00 | 360.00 | 316.56 | 110110 |

| S0002 | Monthly | 240.00 | 12345 | Amount | 30.00 | 360.00 | 316.56 | 110110 |

For item 1000, a renewal term cannot be added because the billing frequency is One time.

Renewal term for both items S0001 and S0002 are added with the following new values (both are the same):

- Start/End date: January 01, 2021 to December 31, 2021

- Unit price is 25.00

- Total extended amount: 300.00

- Total contract amount: 0.00

The allocation amounts for both renewal terms have not been calculated yet.

After invoices for all periods for both items (S0001 and S0002) have been created, the existing revenue allocation is moved to the history. The new revenue allocation is created and calculated based on only the two lines that are renewed.

Also, the current renewal lines are updated with the new total contract revenue.

Use with Milestone Billing

The unbilled revenue functionality can be used with a milestone parent item or with a milestone child item.

Milestone Parent Item

When using the unbilled revenue feature with items that use the milestone billing functionality, ensure that the following areas are completed for the milestone parent item in the Billing Schedule Lines:

- The Unbilled revenue check box is selected

- The start and end dates are specified

The end date is required for creating the initial journal entry. - Billing frequency must be One time

Only the One time billing frequency is available. Currently, the renewals functionality is not available for unbilled items that use the milestone billing feature. - For a deferral item, the Deferred check box is selected

Currently, the deferral functionality for all child items works through the parent milestone item only. Only one deferral schedule for the entire milestone contract based on the milestone parent item and all changes are applied to the child items.

Changes to the milestone parent item can only be made on the Milestone Allocation page. After changes are made, the initial journal entry must be recalculated.

A software company sets up a contract with a customer for a software implementation. The total contract is 100,000.00 with Implementation Services as the main item. The milestone items are as follows:

- 50% = Deposit

- 30% = User acceptance testing (UAT)

- 20% = Go live

The contract is deferred and the service item is unbilled revenue. The contract runs from January 2021 to December 2021.

The contract journal entry that is attached to the milestone parent item is as follows:

| Debit unbilled revenue account | 100,000.00 | ||

| Credit deferred revenue account | 100,000.00 |

First milestone (Deposit): The invoice is created, and the billing end date is set:

| Debit unbilled revenue account (50% of the contract) | 50,000.00 | ||

| Credit unbilled revenue account | 50,000.00 |

Second milestone (UAT): The invoice is created and the billing end date is set: :

| Debit unbilled revenue account (30% of the contract) | 30,000.00 | ||

| Credit unbilled revenue account | 30,000.00 |

Third milestone (Go live): The invoice is created:

| Debit unbilled revenue account (20% of the contract) | 20,000.00 | ||

| Credit unbilled revenue account | 20,000.00 |

Milestone Child Item

When using the unbilled revenue feature with milestone child items, keep in mind the following criteria for the milestone parent item or milestone child item in the Billing Schedule Lines:

- To use the unbilled revenue feature for one or more milestone child items, both the Deferred and Unbilled revenue check boxes for the milestone parent item must be cleared.

- When one or more milestone child items are deferred and/or uses the unbilled revenue feature, both the Deferred and Unbilled revenue check boxes for the milestone parent item are not available.

- Billing frequency must be One time

Only the One time billing frequency is available. Currently, the renewals functionality is not available for unbilled items that use the milestone billing feature. - When the milestone child items area processed, the unbilled revenue journal entries and the deferral schedules are attached to the corresponding milestone child items.

The milestone parent item acts like a regular item and the billing end date for the milestone parent item cannot be edited. - After the unbilled revenue initial journal entry is created for one or more milestone child items, the billing schedule line for the milestone parent item cannot be edited.

- The main account for the milestone child items can be edited. Each milestone child item can use a different financial dimensions, but the main account is the same for all milestone child items. However, if the milestone parent item uses the unbilled revenue feature, all milestone child items must use the same main account as the parent item.

- For the unbilled revenue initial journal entry to be created, the milestone child item requires an end date.

Changes to the milestone child item can only be made on the Milestone Allocation page. After changes are made, the initial journal entry must be recalculated.

The following journal entries are created for milestone child items:

| Non-deferred item | Comment | |||

| Unbilled revenue account | Debit | Unbilled revenue account for the line item. | ||

| Revenue account | Credit | |||

| Deferred item | ||||

| Unbilled revenue account | Debit | Unbilled revenue account for the line item. | ||

| Deferred revenue account | Credit | The deferral schedule is created after the unbilled revenue initial journal is created. The recognition type is credit, and the distribution type is revenue. | ||

A software company sets up a contract with a customer for a software implementation. The total contract is 100,000.00 with Implementation Services as the main item. The milestone items are as follows:

- 50% = Deposit

- 30% = User acceptance testing (UAT)

- 20% = Go live

One of the milestone child items (Go live) is deferred and the child item is also unbilled revenue. The contract runs from January 2021 to December 2021.

The contract journal entry that is attached to the milestone child item is as follows:

| Debit unbilled revenue account | 20,000.00 | ||

| Credit revenue account | 20,000.00 |

First milestone (Deposit): The invoice is created, and the billing end date is set:

| Debit revenue account (50% of the contract) | 50,000.00 | ||

| Credit revenue account | 50,000.00 |

Second milestone (UAT): The invoice is created and the billing end date is set: :

| Debit revenue account (30% of the contract) | 30,000.00 | ||

| Credit revenue account | 30,000.00 |

Third milestone (Go live): The invoice is created:

| Debit revenue account (20% of the contract) | 20,000.00 | ||

| Credit unbilled revenue account (parent account) | 20,000.00 |