In this article

Sales Return Order

Use this page to process a return for a posted sales invoice. For more information, see Process Sales Returns or Cancellations ![]() in the Microsoft Dynamics 365 Business Central documentation.

in the Microsoft Dynamics 365 Business Central documentation.

Return Deferral Item

When the Sales Invoice page is used to create and post a sales invoice with a deferral item, the associated deferral schedule is created for the invoice line.

The Sales Order page can be used to create a sales order for a deferral item. When the item is shipped and an invoice created and posted, the he associated deferral schedule is created for the sales order line.

To return the item from the Sales Return Order page, use the Get Posted Document Lines to Reverse to return the posted sales invoice line. The line selected can be returned in partial or in full. When the return is posted, the associated deferral schedule is adjusted the partial or full amount.

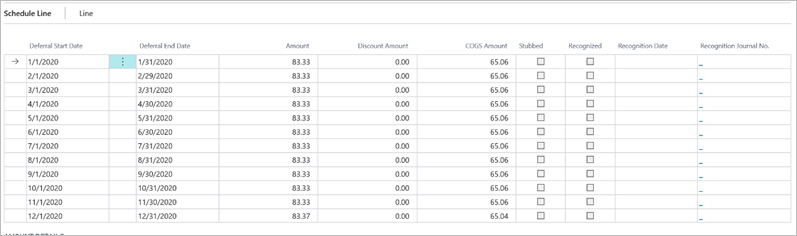

For example, a sales invoice with a deferral item is posted:

- Deferral Amount = 1000.00

- COGS = 780.70

- Quantity = 1 PCS

- Start date = January 01, 2020

- End date = December 31, 2020

Review the following table for how the return is processed.

| Scenario | Lines Recognized | Return Full/Partial | Return Date | Comments |

| 1 | No | Full | March 31 |

When the sales return order is posted, the deferral schedule status changes to Completed. The original amount, original discount, and original COGS amount = 0.00. To view the credit memo document information, select Credit Adjustment > Credit memo. |

| 2 | No | Partial (500.00) | March 31 |

When the sales return order is posted, the deferral schedule status changes to Active. The original amount = 500.00, and original discount and original COGS amount = 0.00. To view the credit memo document information, select Credit Adjustment > Credit memo. The deferral schedule will have three lines for January, February, and March. |

| 3 | Deferral schedule is recognized until March 31 | Full | April 30 |

The recognized revenue amount = 249.99 (January to March), the recognized COGS amount = 195.18 , and the deferral status is Completed. The April 1 – April 30 line in the deferral schedule will have following information:

The recognized revenue amount cannot be reversed since the journals have already been posted. |

| 4 | Deferral schedule is recognized until March 31 | Partial (500.00) | April 30 |

The recognized revenue amount = 249.99 (January to March), the recognized COGS amount = 195.18 , and the deferral status is Active. The April 1 – April 30 line in the deferral schedule will have following information:

|

The example provided also applies to revenue split deferral items, where a parent item has multiple child items, and items that have serial numbers.