In this article

Unbilled Revenue: Examples

Use the unbilled revenue feature when you want to recognize the entire amount of a contract on the balance sheet as unbilled revenue. The other side of the entry is charged to either a revenue or deferred revenue account, depending on the accounting requirements for the transaction. When you recognized unbilled revenue in this way, the customer invoices draw down the unbilled amount and update accounts receivable. No revenue recognition happens at the time of invoicing as the revenue was either recognized when the unbilled amount was posted or will be recognized based deferral recognition schedule that was set up.

Basic Example

A billing schedule is created with the following information:

- Contract length: 3 years

- Amount: 1280.00

- Start date: January 1, 2019

- Includes licenses, consulting services, and maintenance agreement

- Annual invoice in advance for 1st year is 440.00 per year and for 2nd and 3rd year is 420.00 per year

The following table shows the setup:

| Item | Amount | Unbilled Revenue | Deferral Item | Description |

| License | 300.00 | Yes | No |

The license cost is recognized immediately, and will be invoiced over the life of the contract. The unvoiced amount is recorded to the unbilled revenue account. |

| Consulting Services | 900.00 | Yes | Yes | The service revenue is deferred and recognized when it is used. The total services amount is recorded in the unbilled revenue account and will be invoiced annually. |

| Maintenance | 60.00 | No | Yes | The maintenance fees are invoiced once a year immediately. The annual maintenance amount is deferred and recognized monthly. |

| Setup Fees | 20.00 | No | No | One-time setup fee charge |

The initial journal entry for the contract is as follows:

| Account | Debit | Credit | |

| January 1, 2019 | |||

| Debit Unbilled Revenue | 1,200.00 | ||

| Credit License Revenue | 300.00 | ||

| Credit Deferred Consulting Revenue | 900.00 | ||

Journal entries are created only for the item that has the unbilled revenue option selected. The deferral schedule for 900.00 is created at the same time.

The following table shows the invoices and revenue recognition for the first year.

| Account | Debit | Credit | Description | |

| January 1, 2019 | ||||

| Debit Accounts Receivable | 440.00 | |||

| Credit Unbilled Revenue | 100.00 | License | ||

| Credit Unbilled Revenue | 300.00 | Consulting Services | ||

| Credit Deferred Maintenance Revenue | 20.00 | Maintenance | ||

| Credit Setup Fee revenue | 20.00 | Setup Fee | ||

The Maintenance item is deferred for a year, and the deferral schedule is created with the monthly revenue recognized. For the next two years , the invoices and deferral schedules will be created similar to the first year, except the setup fee is not added because it is for the first year only.

Deferral Example

A billing schedule has the following items:

| Item | Price | Discount | Unbilled Revenue | Deferral Item |

| A | 100.00 | 10.00 | Y | Y |

| B | 200.00 | 20.00 | Y | N |

| C | 50.00 | 5.00 | N | Y |

| D | 50.00 | 5.00 | N | N |

The initial journal entry for the contract is as follows:

| Account | Debit | Credit | Description | |

| Dr. Unbilled Revenue | 300.00 | |||

| Cr. Revenue | 200.00 |

Non-deferrable Item marked with Unbilled Revenue (Item B). |

||

| Cr. Deferred Revenue | 100.00 |

Deferrable Item marked with Unbilled Revenue (Item A). |

||

| Cr. Unbilled Discount | 30.00 |

Discount of the item marked with Unbilled Revenue (Item A and B). |

||

| Dr. Deferred Discount | 10 | Item A | ||

| Dr. Discount | 20 | Item B |

The invoice is as follows:

| Account | Debit | Credit | Description | |

| Debit Accounts Receivable | 360.00 | |||

| Debit Unbilled Discount | 30.00 |

Discount of the item marked with Unbilled Revenue (Items A and B). |

||

| Debit Discount | 10.00 |

Discount of the item without Unbilled Revenue (Items C and D). |

||

| Credit Unbilled Revenue | 300.00 |

Items marked with Unbilled Revenue, deferred and non-deferred (Items A and B). |

||

| Credit Deferred Revenue | 50.00 |

Deferrable item without Unbilled Revenue (Item C). |

Deferral with Short-Term/Long-Term

When the short-term or long-term deferrals feature is used and an item is deferrable, the deferred revenue account is substituted with the short-term and long-term deferred revenue accounts. The calculations for the short-term and long-term split are the same based on the Short-term Deferral Method selected on the SBS ARED Advanced Revenue & Expense Deferrals Setup (rolling period or fixed years).

For example, a billing schedule has a deferral Item A with the following:

- Deferred for 24 months

- Price is 1000.00 per month, with 100.00 discount

- Short-term unbilled method is rolling period

The initial journal entry for the contract is as follows:

| Account | Debit | Credit | |

| Debit Unbilled Revenue | 24,000.00 | ||

| Credit Short-Term Deferred Revenue | 12,000.00 | ||

| Credit Long Term Deferred Revenue | 12,000.00 | ||

| Debit Short Term Deferred Discount | 1,200.00 | ||

| Debit Long Term Deferred Discount | 1,200.00 | ||

| Credit Unbilled Discount | 2,400.00 |

The invoice is as follows:

| Account | Debit | Credit | |

| Debit Accounts Receivable | 900.00 | ||

| Credit Unbilled Revenue | 100.00 | ||

| Debit Unbilled Discount | 100.00 |

Deferral with Profit & Loss

When the Deferral Posting Method is set to Profit & Loss on the SBS ARED Advanced Revenue & Expense Deferrals Setup and the item is deferrable, the deferred revenue account is substituted with the profit and loss account.

For example, a billing schedule has a deferral Item A with the following:

- Deferred for 12 months

- Price is 1000.00 per month, with 100.00 discount

The initial journal entry for the contract is as follows:

| Account | Debit | Credit | Description | |

| Debit Unbilled Revenue | 12,000.00 | |||

| Credit Initial Account | 12,000.00 | |||

| Debit Offset Account | 12,000.00 | |||

| Credit Deferred Revenue | 12,000.00 | |||

| Credit Unbilled Discount | 12,000.00 | |||

| Debit Deferred Discount | 12,000.00 |

The invoice is as follows:

| Account | Debit | Credit | Description | |

| Debit AR | 900.00 | |||

| Credit Unbilled Revenue | 100.00 | |||

| Debit Unbilled Discount | 100.00 |

Use with Milestone Billing

The unbilled revenue functionality can be used with a milestone parent item or with a milestone child item.

Milestone Parent Item

When using the unbilled revenue feature with items that use the milestone billing functionality, ensure that the following areas are completed for the milestone parent item in the Schedule Lines for a billing schedule:

- The Unbilled Revenue check box is selected

- The start and end dates are specified

The end date is required for creating the initial journal entry. - Billing frequency must be One Time

Only the One Time billing frequency is available. Currently, the renewals functionality is not available for unbilled items that use the milestone billing feature. - For a deferral item, the Deferred check box is selected

Currently, the deferral functionality for all child items works through the parent milestone item only. Only one deferral schedule for the entire milestone contract based on the milestone parent item and all changes are applied to the child items.

Changes to the milestone parent item can only be made on the SBS ARCB Milestone Details page. After changes are made, the initial journal entry must be recalculated.

A software company sets up a contract with a customer for a software implementation. The total contract is 100,000.00 with Implementation Services as the main item. The milestone items are as follows:

- 50% = Deposit

- 30% = User acceptance testing (UAT)

- 20% = Go live

The contract is deferred and the service item is unbilled revenue. The contract runs from January 2021 to December 2021.

The contract journal entry that is attached to the milestone parent item is as follows:

| Debit unbilled revenue account | 100,000.00 | ||

| Credit deferred revenue account | 100,000.00 |

First milestone (Deposit): The invoice is created, and the billing end date is set:

| Debit unbilled revenue account (50% of the contract) | 50,000.00 | ||

| Credit unbilled revenue account | 50,000.00 |

Second milestone (UAT): The invoice is created and the billing end date is set: :

| Debit unbilled revenue account (30% of the contract) | 30,000.00 | ||

| Credit unbilled revenue account | 30,000.00 |

Third milestone (Go live): The invoice is created:

| Debit unbilled revenue account (20% of the contract) | 20,000.00 | ||

| Credit unbilled revenue account | 20,000.00 |

Milestone Child Item

When using the unbilled revenue feature with milestone child items, keep in mind the following criteria for the milestone parent item or milestone child item in the Schedule Lines for a billing schedule:

- To use the unbilled revenue feature for one or more milestone child items, both the Deferred and Unbilled Revenue check boxes for the milestone parent item must be cleared.

- When one or more milestone child items are deferred and/or uses the unbilled revenue feature, both the Deferred and Unbilled Revenue check boxes for the milestone parent item are not available.

- Billing frequency must be One Time

Only the One Time billing frequency is available. Currently, the renewals functionality is not available for unbilled items that use the milestone billing feature. - When the milestone child items area processed, the unbilled revenue journal entries and the deferral schedules are attached to the corresponding milestone child items.

The milestone parent item acts like a regular item and the billing end date for the milestone parent item cannot be edited. - After the unbilled revenue initial journal entry is created for one or more milestone child items, the billing schedule line for the milestone parent item cannot be edited.

- The main account for the milestone child items can be edited. Each milestone child item can use a different financial dimensions, but the main account is the same for all milestone child items. However, if the milestone parent item uses the unbilled revenue feature, all milestone child items must use the same main account as the parent item.

- For the unbilled revenue initial journal entry to be created, the milestone child item requires an end date.

Changes to the milestone child item can only be made on the SBS ARCB Milestone Details page. After changes are made, the initial journal entry must be recalculated.

The following journal entries are created for milestone child items:

| Non-deferred item | Comment | |||

| Unbilled revenue account | Debit | Unbilled revenue account for the line item. | ||

| Revenue account | Credit | |||

| Deferred item | ||||

| Unbilled revenue account | Debit | Unbilled revenue account for the line item. | ||

| Deferred revenue account | Credit | The deferral schedule is created after the unbilled revenue initial journal is created. The recognition type is credit, and the distribution type is revenue. | ||

A software company sets up a contract with a customer for a software implementation. The total contract is 100,000.00 with Implementation Services as the main item. The milestone items are as follows:

- 50% = Deposit

- 30% = User acceptance testing (UAT)

- 20% = Go live

One of the milestone child items (Go live) is deferred and the child item is also unbilled revenue. The contract runs from January 2021 to December 2021.

The contract journal entry that is attached to the milestone child item is as follows:

| Debit unbilled revenue account | 20,000.00 | ||

| Credit revenue account | 20,000.00 |

First milestone (Deposit): The invoice is created, and the billing end date is set:

| Debit revenue account (50% of the contract) | 50,000.00 | ||

| Credit revenue account | 50,000.00 |

Second milestone (UAT): The invoice is created and the billing end date is set: :

| Debit revenue account (30% of the contract) | 30,000.00 | ||

| Credit revenue account | 30,000.00 |

Third milestone (Go live): The invoice is created:

| Debit revenue account (20% of the contract) | 20,000.00 | ||

| Credit unbilled revenue account (parent account) | 20,000.00 |

Termination Example

The following table shows the information for a billing schedule contract that has been terminated.

| Item | Contract Amount | Unbilled Revenue | Deferrable | Billing Period | Billing Amount |

| License | 300.00 | Yes | No | January 1, 2019 – December 31, 2021 | 100.00 a year |

| Maintenance | 60.00 | No | Yes | January 1, 2019 – December 31, 2021 | 20.00 a year |

| Support | 150.00 | Yes | Yes | January 1, 2019 – December 31, 2021 | 50.00 a year |

| Equipment Rental | 360.00 | No | No | January 1, 2019 – December 31, 2021 | 10.00 a month |

The initial journal entry for the contract is as follows:

| Account | Debit | Credit | Description | |

| January 1, 2019 | ||||

| Debit Unbilled Revenue | 300.00 | License | ||

| Credit Revenue | 300.00 | |||

| Debit Unbilled Revenue | 150.00 | Support | ||

| Credit Deferred Revenue | 150.00 | |||

The deferral schedule for the Support item (150.00) is also created at the same time.

The following table shows the second Annual Invoice.

| Account | Debit | Credit | Description | |

| January 1, 2019 and January 1, 2020 | ||||

| Debit Accounts Receivable | 180.00 | |||

| Credit Unbilled Revenue | 100.00 | License | ||

| Credit Deferred Revenue | 20.00 | Maintenance | ||

| Credit Unbilled Revenue | 50.00 | Support | ||

| Credit Revenue | 10.00 | Equipment Rental | ||

The monthly invoice is as follows:

| Account | Debit | Credit | Description | |

| Feb 1, 2019 – Dec 1, 2019 and Feb 1, 2020 – Sep 30, 2020 | ||||

| Debit Accounts Receivable | 10.00 | |||

| Credit Revenue | 10.00 | Equipment Rental | ||

Deferral schedules are created for the Maintenance and Support items.

- 2019 - both items are deferred for the year and recognized fully

- 2020 - both items are deferred for the year and recognized up until September 30, 2020

The billing schedule is to be terminated with the termination date of October 10, 2020. The General Ledger account balances before termination are as follows:

| Licenses | Description |

| Unbilled Revenue: | 300.00 (initial JE) - 200.00 (invoiced) = 100.00 |

| Revenue: | 300.00 (initial JE) |

| Unbilled Revenue: | Until December 2021 (Reverse October 11 – December 31, 2021) |

| Invoiced: | Until December 2020 (Refund for October 11 – December 31) |

| Revenue: | Until December 2020 (Reverse October 11 – December 31) |

| Support: | |

| Unbilled Revenue: | 150.00 (initial JE) - 100.00 (invoiced) = 50.00 |

| Revenue: | 87.50 (recognized) |

| Deferred Revenue: | 150.00 (deferred)- 88.00 (recognized) = 62.00 |

| Unbilled Revenue: | Until December 2021 (Reverse October 11 – December 31, 2021) |

| Invoiced: | Until December 2020 (Refund for October 11 – December 31) |

| Revenue: | Until September 2020 (Recognize October 1 – October 10) |

| Deferred Revenue: | Until December 2020 (Reverse October 11 – December 31) |

| Maintenance: | |

| Revenue: | 35.00 (recognized) |

| Deferred Revenue: | 40.00 (deferred) - 35.00 (recognized) = 5.00 |

| Invoiced: | Until December 2020 (Refund for October 11 – December 31) |

| Revenue: | Until September 2020 (Recognize October 1 – October 10) |

| Deferred Revenue: | Until December 2020 (Reverse October 11 – December 31) |

| Equipment: | |

| Revenue: | 210.00 (invoiced) |

| Invoiced: | Until September 2020 (Invoice for October 1 - October 10) |

| Revenue: | Until September 2020 (Recognize October 1 – October 10) |

Licenses and Support

When the billing schedule is terminated, the unbilled revenue journal entry is reversed to clear the unbilled revenue account balance. The offset account for the journal entries is revenue or deferred revenue, as was used initially.

Licenses:

- 300.00 recorded until December 2021

- 122.00 reverse October 11 – December 31, 2021 - 300.00 / 36 month x (14 month + 20/ 30 days)

Support:

- 150.00 recorded until December 2021

- 61.11 reverse October 11 – December 31, 2021 - 150 / 36 month x (14 month + 20/ 30 days)

| Debit Revenue | 122.00 | License | ||

| Credit Unbilled Revenue | 122.00 | |||

| Debit Deferred Revenue | 61.11 | Support | ||

| Credit Unbilled Revenue | 61.11 |

Support

The Support item, which has a deferral schedule is adjusted to be shortened up to the termination date of October 10, 2020. The deferral schedule for the Support item is adjusted as follows:

- Deferred Revenue: 150.00 until December 2021

- Recognized Revenue: 87.50 until September 2020

- Unrecognized Revenue: 62.00

The schedule is shortened to October 10, 2020. The last revenue recognition is run for the period October 1 - October 10, 2020 to recognize revenue of 1.38 (150 / 36 month x 10/30 days).

Assume the same Support ARED schedule was recognized until Oct 30, 2020. In this case, the schedule is shortened to the termination date of Oct 10, 2020, and over-recognized revenue gets reversed:

-

Dr Revenue: 2.78 $150 / 36 mon x 20/30 days

-

Cr Deferred Revenue: 2.78

Maintenance

The Maintenance item, which has a deferral schedule is adjusted to be shortened up to the termination date of October 10, 2020. The last revenue recognition is run for the period October 1 - October 10, 2020 to recognize revenue of 0.56 (60 / 36 month x 10/30 days).

Invoices for the Licenses, Support, and Maintenance created until December 2020. The refund (credit memo) is to be created as follows:

| Account | Debit | Credit | Description | |

| October 10, 2020 | ||||

| Revenue | 22.22 | License - 100.00 / 12 month x 2 month x 20/30 days | ||

| Debit Deferred Revenue | 4.44 | Maintenance - 20.00 / 12 month x 2 month x 20/30 days | ||

| Debit Unbilled Revenue | 11.11 | Support - 50.00 / 112 month x 2 month x 20/30 days | ||

| Credit Accounts Receivables | 37.77 | |||

An invoice for the Equipment Rental is created until the end of September 2020. A last invoice for the period October 1 - October 10 is created:

| Account | Debit | Credit | Description | |

| October 1, 2020 | ||||

| Debit Accounts Receivables | 3.33 | |||

| Credit Revenue | 3.33 | 10 / 30 days x 10 days | ||

The General Ledger balances after the termination are as follows:

| Licenses | Description |

| Unbilled Revenue: | 300.00 (initial JE) - 200.00 (invoiced) - 122.00 (reversed) + 22.00 (refund) = 0.00 |

| Revenue: | 300.00 (initial JE) - 122.00 (reversed) = 178.00 – revenue from January 1, 2019 to October 10, 2020 |

| AR: | 200.00 (invoiced) - 22.00 (refund) = 178.00 – invoiced from January 1, 2019 to October 10, 2020 |

| Support: | |

| Unbilled Revenue: | 150.00 (initial JE) - 100.00 (invoiced) - 61.00 (reversed) + 11.00 (refund) = 0.00 |

| Revenue: | 87.50 (recognized) + 1.38 (to be recognized) = 88.88 – revenue January 1, 2019 to October 10, 2020 |

| AR: | 100.00 (invoiced) - 11.12 (refund) = 88.88 – invoiced January 1, 2019 to October 10, 2020 |

| Deferred Revenue: | 150.00 (deferred)- 87.50 (recognized) - 61.11 (reversed) - 1.38 (to be recognized) = 0.00 |

| Maintenance: | |

| Revenue: | 35.00 (recognized) + 0.56 (to be recognized) = 36.56 revenue January 1, 2019 to October 10, 2020 |

| Deferred Revenue: | 40.00 (deferred)- 35.00 (recognized) - 4.44 (refund) - 0.56 (to be recognized) = 0.00 |

| AR: | 40.00 (invoiced) - 4.44 (refund) = 35.56 – invoiced January 1, 2019 to October 10, 2020 |

| Equipment: | |

| Revenue: | 210.00 (invoiced) + 3.33 (to be invoiced) = 213.33– invoiced January 1, 2019 to October 10, 2020 |

| AR: | 210.00 (invoiced) + 3.33 (to be invoiced) = 213.33– revenue January 1, 2019 to October 10, 2020 |

Proration Method

When the amount for a partial period is calculated, one of the following proration calculation methods can be used for calculating refunds and adjustments: Monthly or Daily.

For example, a billing schedule for an item is as follows:

- Length of 36 months

- Item price is 300.00

- Start date is January 01, 2019

- Termination date is October 10, 2020

With Monthly proration, the refund is calculated as follows:

(300.00 / 36 months) * (14 + (20 / 30 months)) = 122.00

With Daily proration, the refund is calculated as follows:

(300 / 1095) * 445 = 122.19

Contract Modification Example

A billing schedule from January 01, 2019 to December 31, 2021, has the following information:

| Item | Qty | Unit Price | Contract Amount | Unbilled Revenue | Deferrable | Billing Amount |

| License A | 20 | 20.00 | 14,400.00 | Yes | No | 4,800.00 a year |

| Support A | 20 | 10.00 | 7,200.00 | Yes | Yes | 2,400.00 a year |

The initial journal entries are as follows:

| Account | Debit | Credit | Description | |

| January 1, 2019 | ||||

| Debit Unbilled Revenue | 14,400.00 | License A | ||

| Credit Revenue | 14,400.00 | |||

| Debit Unbilled Revenue | 7,200.00 | Support A | ||

| Credit Deferred Revenue | 7,200.00 | |||

A deferral schedule for 7,200.00 for the Support A item is created at the same time.

Two annual invoices are created.

| Account | Debit | Credit | Description | |

| January 1, 2019 and January 1, 2020 | ||||

| Debit Accounts Receivable | 7,200.00 | |||

| Credit Unbilled Revenue | 4,800.00 | License A | ||

| Credit Unbilled Revenue | 2,400.00 | Support A | ||

The deferral schedules for the Support A item are as follows:

- 2019 – recognized fully.

- 2020 – recognized up until Sep 30, 2020.

On October 1, 2020, the billing schedule is changed as follows:

License and Support quantities changed to 10 and two more items are added. The billing period for the new items is October 1, 2020 to December 31, 2021 (aligned to the original items).

| Item | Qty | Unit Price | Contract Amount | Unbilled Revenue | Deferrable | Billing Amount |

| License B | 10 | 15.00 | 2250.00 | Yes | No | 1,800.00 a year |

| Support B | 10 | 5.00 | 750.00 | Yes | Yes | 600.00 a year |

The additional journal entries are as follows:

| Account | Debit | Credit | Description | |

| October 1, 2020 | ||||

| Debit Unbilled Revenue | 3000.00 | |||

| Credit Revenue | 2250.00 | License B | ||

| Credit Deferred Revenue | 750.00 | Support B | ||

A deferral schedule for 750.00 for the Support B item is created at the same time.

Adjustments for License A and Support A are as follows:

| Account | Debit | Credit | Description | |

| October 1, 2020 | ||||

| Debit Revenue | 6,000.00 | 20 x 20.00 x 15 months - old amount License A | ||

| Credit Unbilled Revenue | 6,000.00 | |||

| Debit Unbilled Revenue | 3,000.00 | 10 x 20.00 x 15 months - new amount License A | ||

| Credit Revenue | 3,000.00 | |||

| Debit Deferred Revenue | 3,000.00 | 20 x 10.00 x 15 months - old amount Support A | ||

| Credit Unbilled Revenue | 3,000.00 | |||

| Debit Unbilled Revenue | 1,500.00 | 10 x 10.00 x 15 months - new amount Support A | ||

| Credit Deferred Revenue | 1,500.00 | |||

The deferral schedule for Support A item is adjusted.

- Adjust the deferral amount of Support A schedule (3,000.00 old amount - 1,500.00 new amount) to be reduced by 1,500.00 from October 1, 2020.

1,500.00 /15 = 100.00 – remaining periods get reduced by 100.00 which is the same as 10.00 x 10 qty = 100.00 new monthly deferred amount after the contract modification.

![]() Note: If the October period is recognized, reverse the recognition journal entries for October so that the new amount can be recognized.

Note: If the October period is recognized, reverse the recognition journal entries for October so that the new amount can be recognized.

Since the invoice for License A and Support A was created for the entire year, the refund (credit memo) is created to refund the over-invoiced amount.

| Account | Debit | Credit | Description | |

| October 1, 2020 | ||||

| Unbilled Revenue | 600.00 | License - 20.00 x (20-10) x 3 months | ||

| Dr Unbilled Revenue | 300.00 | Support - 20.00 x (20-10) x 3 months | ||

| Cr AR | 900.00 | |||

The annual invoices for the third year are as follows:

| Account | Debit | Credit | Description | |

| January 1, 2021 | ||||

| Debit Accounts Receivables | 6,000.00 | |||

| Credit Unbilled Revenue | 2,400.00 | License A | ||

| Credit Unbilled Revenue | 1,200.00 | Support A | ||

| Credit Unbilled Revenue | 1,800.00 | License B | ||

| Credit Unbilled Revenue | 600.00 | Support B | ||

Unbilled Revenue with Other Features

Review the following example and table to better understand how the unbilled revenue feature works with other billing schedule features.

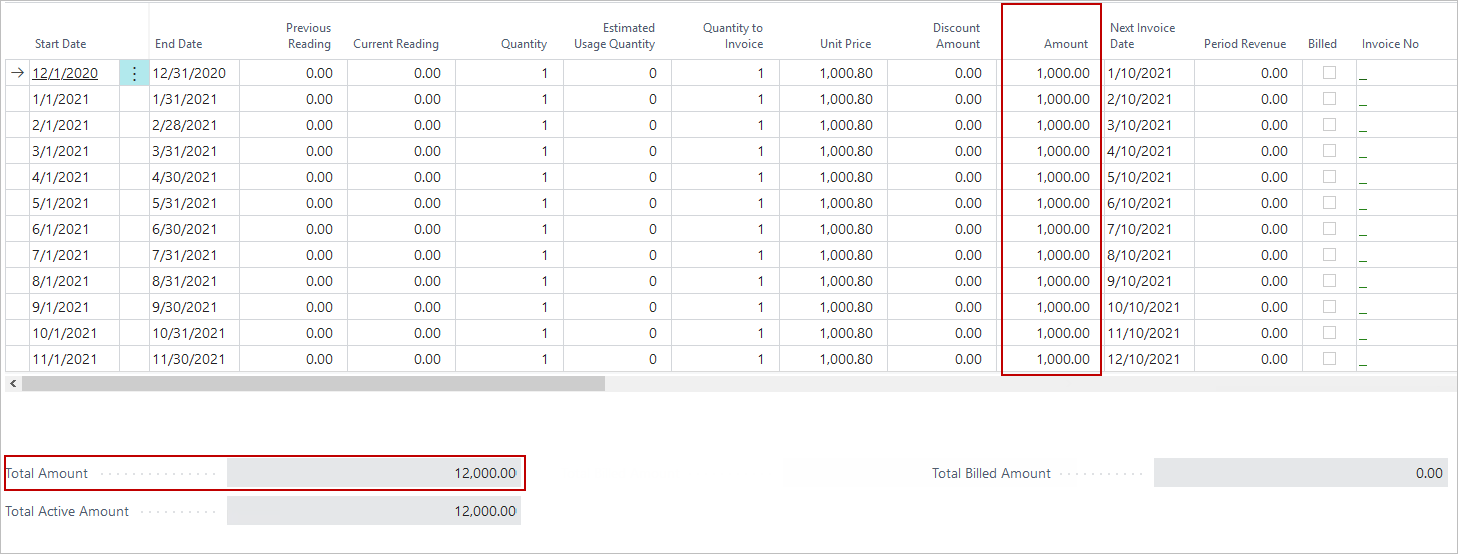

A billing schedule with the following is created:

- Amount: 1000.00

- Frequency: Monthly

- Number of Periods: 12

The billing details are as follows:

On the SBS ARCB Billing Schedule Card, you can turn on or off the following billing schedule functionality:

| Functionality | Description |

| Min/Max and Free Qty |

When this feature is turned on for the billing schedule with a total contract value of 1000.00, the initial journal entry is created for 200, and the following information appears in the audit table. If the deferral schedule is created initially for 1200.00, it is changed for 1000.00. |

| Price Adjustment |

When an price adjustment is applied, the billing schedule contract value is 1400.00. The initial journal entry is created for 400.00, and the following information appears in the audit table. If the deferral schedule is created initially for 1200.00, it is changed for 1400.00. |

| Hold or Terminate |

A hold is applied to a billing schedule with a contract value of 300.00. The initial journal entry is created for 900.00, and the following information appears in the audit table. If the deferral schedule is created initially for 1200.00, it is changed for 300.00. |

| Invoice |

When the invoice is created for the item that uses unbilled revenue, the deferral schedule is not created. The deferral schedule is created at the time the initial journal entry is created. The additional journal entry to offset the unbilled revenue account is created. |

|

Changes to the

|

The quantity is changed and the total contract value for the billing schedule changes from 1200.00 to 2400.00. The initial journal entry is created for 1200.00 and the following appears in the audit table. If the deferral schedule is created initially for 1200.00, it is changed for 2400.00. |