In this article

Advanced Revenue & Expense Deferrals Parameters

Modules > Advanced revenue & expense deferrals > Setup > Advanced revenue & expense deferrals parameters

Use this page to set the default preferences and settings for Advanced Revenue & Expense Deferrals (ARED). The settings are effective company-wide.

Set Up Default Values

You set up the default values in the General tab:

- In Equal per period, select whether the number of days in each period is considered or if all periods are considered to have the same number of days.

- For the Sales discount deferral option, select whether the discount amounts appear on a different deferral schedule from the deferral schedule for the sales order.

- For the Purchasing discount deferral option, select whether the discount amounts appear on a different deferral schedule from the deferral schedule for the purchase order.

- Select whether you want to Consolidate prior periods.

- Select how the Default deferral start date is determined.

This option applies to deferral schedules that originate from the Sales Order page - If you use short-term deferrals, select the Short-term deferral method and the Deferral posting method.

- When recognizing a deferral schedule, select the journal options:

- Select whether to Automatically post general journals.

- Select whether to Summarize recognition journal transactions so they are consolidated.

- Select the Default journal name for any journal transaction created from an ARED process.

- Select the source data for the Recognition journal line description.

- Select Save.

If the Deferral posting method is Profit and loss, select whether you want to be able to reverse the profit and loss amount when a credit adjustment is processed. For more information, review the description for the Reverse profit and loss on credit option.

Set Up Auto Numbering

To set up the automatic number for billing schedules, do the following:

- Select the Number sequences tab.

- Check that the Number sequence code has a value.

- If the number sequence code is empty, you must generate the number sequence for the Reference number you want.

For more information, see the Microsoft Dynamics 365 for Finance and Operations documentation. - If the number sequence has a value, continue to the next step.

- If the number sequence code is empty, you must generate the number sequence for the Reference number you want.

- Select Save.

Fields

This page contains the following fields:

| Field | Description | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Schedule | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Schedule | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equal per period |

Specify whether the number of days in a period is taken into consideration when calculating the amount in each period for a deferral schedule.

You can override this setting at the transaction level. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sales discount deferral option |

Select whether separate deferral schedules are created for the discount and the sales order amounts:

When a sales order is created and then posted, two deferral schedules are created, and the discount and revenue amounts are posted to different deferral accounts. When a sales order is created and then posted, one deferral schedule is created and both the discount and revenue amounts are posted to the same deferral account.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Purchasing discount deferral option |

Select whether separate deferral schedules are created for the discount and the purchase order amounts:

When a purchase order is created and then posted, two deferral schedules are created, and the discount and expense amounts are posted to different deferral accounts. When a purchase order is created and then posted, one deferral schedule is created and both the discount and expense amounts are posted to the same deferral account.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidate prior periods |

Select whether to consolidate deferral schedule lines for prior periods.

If the deferral start date is in the same or a later period as the transaction date, this option has no effect. You can override this setting at the transaction level. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Default deferral start date |

Select the rule to apply to the transaction date to get the start date for the deferral schedule:

You can override this setting at the transaction level. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Short-term deferral method |

Select the short-term deferral method: None (default), Rolling periods, or Fixed year. For information on how these settings work, see Short-Term Deferral Calculation. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deferral posting method |

Select the method used to create deferral transactions:

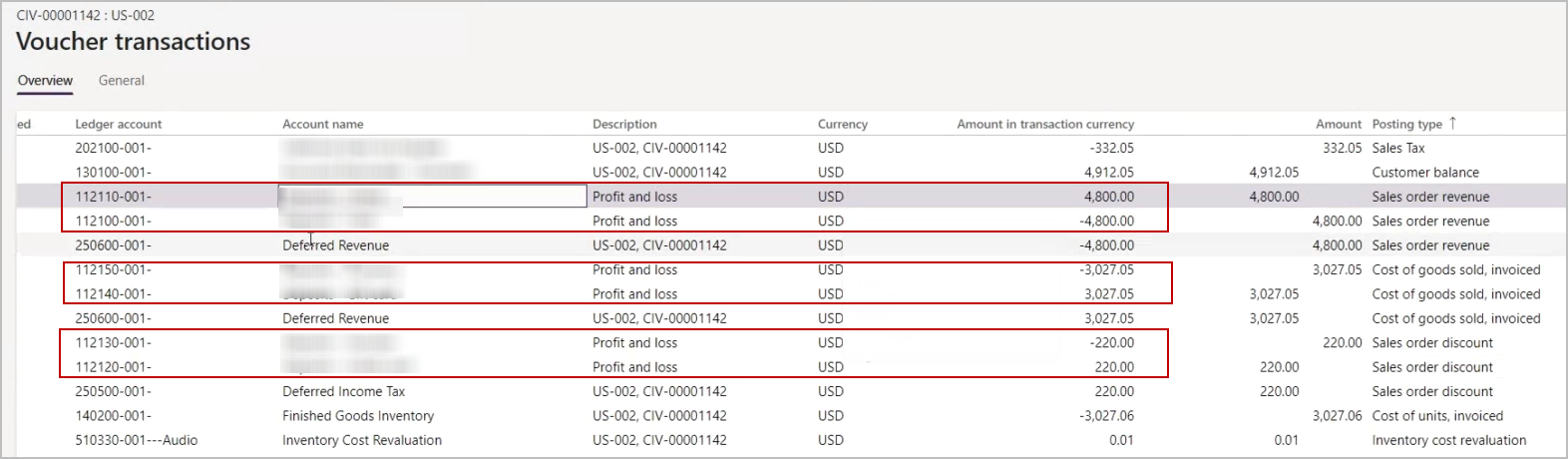

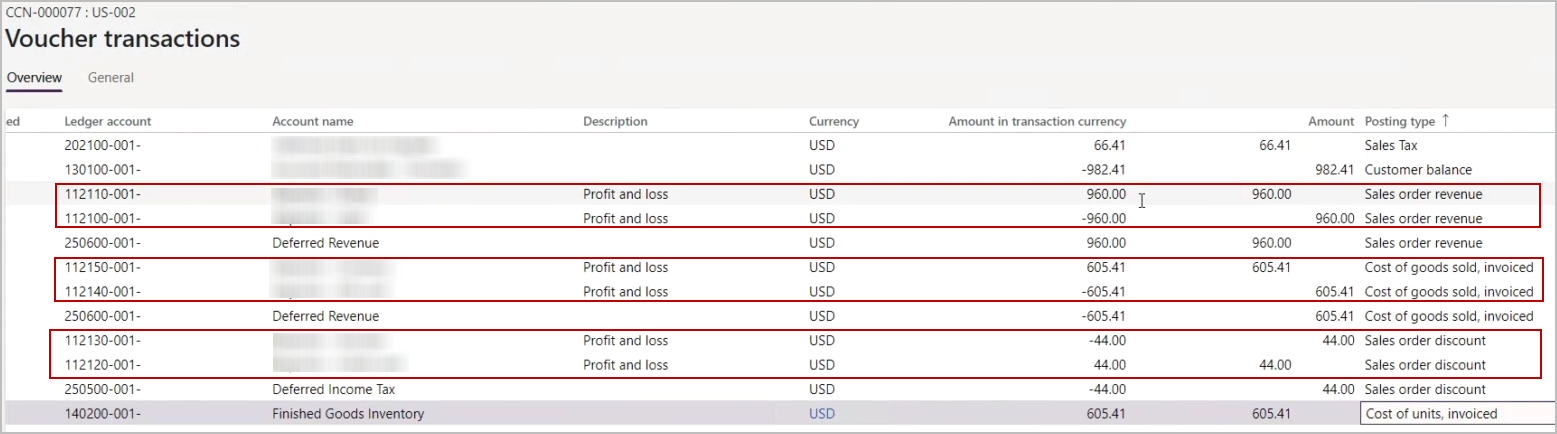

The following examples demonstrate the distributions when the Deferral posting method for sales and purchase invoices is set to Profit & Loss. Sales Invoice ProcessingThe following examples show the distribution when a sales invoice that includes a deferrable item is posted. The following table shows the distribution

The following table shows the distribution:

Item A102-58 is sold with the extended price 1,200.00, 10% discount and COGS value of 300.00. The following table shows the distribution:

Purchase Invoice ProcessingThe following example shows the distribution when a purchase invoice that includes a deferrable item is posted. The following table shows the distribution:

Item A102-58 is purchased with the extended price 1,200.00 and a 10% discount. The following table shows the distribution:

After a sales or purchase invoice is posted, the deferral schedule is created. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reverse profit and loss on credit |

Available when Deferral posting method is Profit and Loss. Select whether the profit and loss amounts are reversed when a reversal, termination, or refund is applied to a billing schedule or sales order.

If the reversal occurs halfway through a billing period, the amounts are prorated. A sales order for a deferrable item is created and the transaction is posted. On the Voucher Transactions page, the following entries appear. In this situation, the distributions are as follows:

Profit and loss entries appear for revenue, COGS, and discount. When a credit note is created for this invoice, the distributions are as follows:

Reversal entries for the profit and loss appear for revenue, COGS, and discount. Also, on the Schedules page, you can see that the Adjustment amount for the deferral schedules for each of the amounts. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Recognition | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Automatically post general journals |

Select whether any journal entries created by ARED, such as those from recognition processing, should be automatically posted.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Summarize recognition journal |

Select whether to consolidate recognition vouchers by default.

You can override this setting on the Recognition processing form. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Default journal name |

Specify the journal name for any journal created from ARED processes, such as recognition processing. You can override this setting at the transaction level. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Recognition journal line description |

Select the description that you want to appear in the journal voucher line description:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number sequences | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Use this tab to set the default deferral schedule number sequence. Before setting up the number sequences, review Generate Number Sequences. Number sequences are automatically generated and assigned using the number sequence generation wizard. You do not need to change the number sequence unless you want to make manual changes on top of the generated number sequences. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Schedule number |

Displays the number sequence used for deferral schedules. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||